The financial services technology sector is evolving substantially, with CIOs and their teams gearing up for the next wave of digital transformation. Faced with formidable challenges in a competitive field marked by escalating cost pressures, financial institutions must overhaul their technology infrastructure to facilitate comprehensive digitization across all facets of their operations, spanning customer-facing and internal processes.

Moreover, the changing environment poses significant challenges to technology capabilities, including transitioning to remote work and emerging cybersecurity in banking. Consequently, CIOs must proactively anticipate and prepare for the impending shift towards accelerated adoption of digital channels.

The urgency for action is widely recognized among leading financial institutions, prompting them to initiate crucial transformations. Yet, it’s crucial to note that these efforts are still in their infancy. Despite the momentum, most institutions are only starting to traverse this path. Beyond the abovementioned pressures, many encounter obstacles to securing funding, grappling with complexity, and navigating talent shortages.

The Evolution of Finance Technology

The journey of financial technology (fintech trends) traces back to the early days of electronic trading and online banking. With the advent of the Internet, traditional banking services transitioned into the digital field, offering customers unprecedented convenience and accessibility. The proliferation of smartphones further accelerated this shift, paving the way for mobile banking apps and contactless payments.

As technology continued to advance, so did the proficiencies of fintech trends. The progress of artificial intelligence (AI), machine learning (ML), and big data analytics revolutionized risk management, fraud detection, and customer service in finance. Moreover, blockchain technology emerged as a game-changer, introducing decentralized systems and cryptocurrencies that challenged traditional banking models.

Useful Link: Successful Digital Transformation: CEO’s Path to Digital Transformation Success

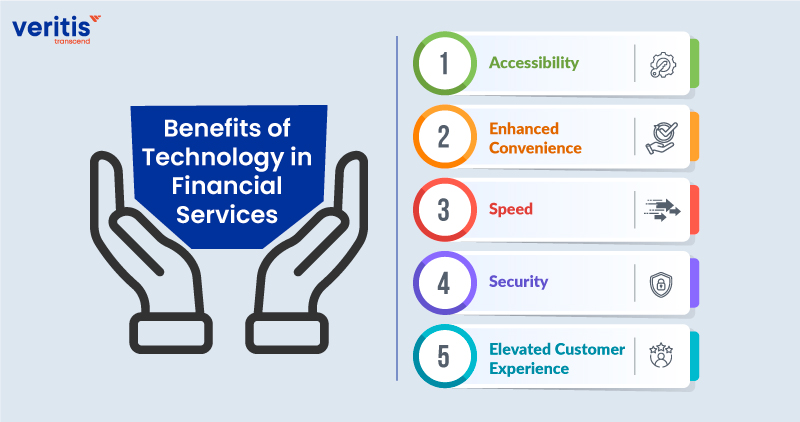

Benefits of Technology in Financial Services

Undoubtedly, technology integration within the financial services sector has ushered in many benefits, fundamentally reshaping the domain of global finance. Here are the transformative advantages that technology has ushered into financial services companies:

1) Accessibility

Technology has democratized access to financial services companies, transcending geographical barriers and providing inclusive coverage to individuals worldwide. Mobile connectivity and digital platforms have made it effortless for people from diverse locations to avail themselves of banking services, eliminating the constraints imposed by traditional brick-and-mortar establishments.

2) Enhanced Convenience

The paradigm shift by financial technology companies has revolutionized user convenience. Through intuitive mobile banking applications and streamlined digital platforms, individuals can seamlessly perform myriad financial tasks at their fingertips, from account registration to fund transfers. This departure from the cumbersome processes of traditional banking has vastly improved the user experience and expedited service delivery.

3) Speed

Financial technology solutions have propelled transaction speeds to unprecedented levels, offering instantaneous processing times that align with the fast-paced demands of modern life. Gone are the days of enduring prolonged waiting periods for transactions to be completed; fintech trends ensure swift and efficient execution, enhancing efficiency and productivity across the financial ecosystem.

4) Security

Technology has introduced robust measures to safeguard sensitive data and thwart malicious activities to address the paramount concern of safety and security within the financial field. Advanced encryption protocols, fraud detection algorithms, and breach prevention mechanisms bolster the security posture of financial institutions, instilling confidence in customers and preserving the integrity of their financial assets.

5) Elevated Customer Experience

Perhaps the most profound impact of technology on financial services lies in its ability to elevate the customer experience to unprecedented levels of personalization and efficiency. Technological innovations have revolutionized customer interactions, from the seamless functionality of mobile payment systems to the sophistication of artificial intelligence in financial services, fostering deeper engagement and satisfaction. Moreover, integrating artificial intelligence in financial services leverages big data to tailor personalized experiences, enhancing customer-centricity and loyalty.

In essence, the pervasive influence of technology within the financial services companies domain has transcended mere convenience, heralding a new era of accessibility, efficiency, and security. As financial industries continue to harness the power of technology-driven solutions, the trajectory of global finance is poised for further innovation and transformation, promising unparalleled benefits for both businesses and consumers alike.

Useful Link: 5 Reasons Why Financial Sector Needs Identity and Access Management (IAM)

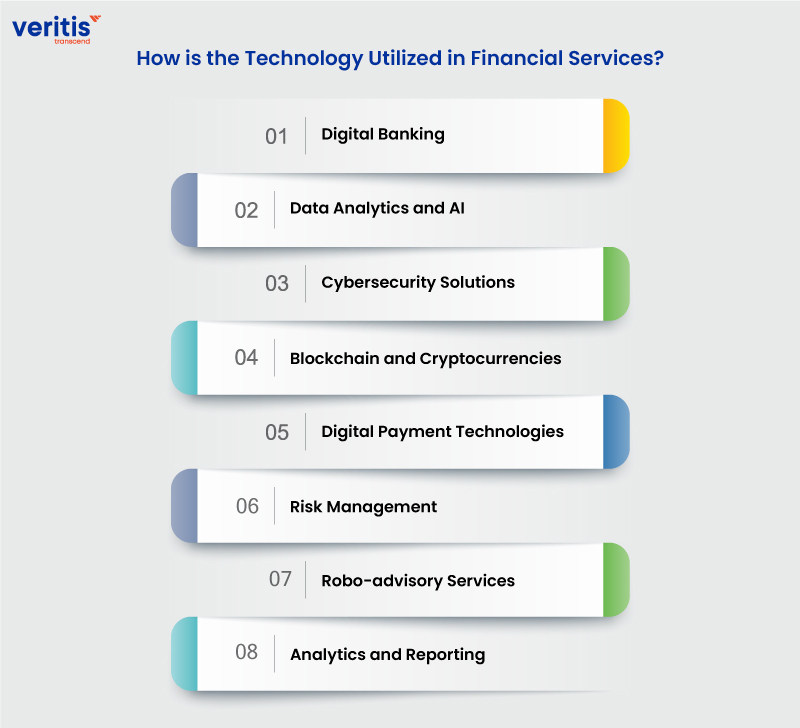

How is the Technology Utilized in Financial Services?

Technology integration into financial services has revolutionized how financial institutions operate and interact with customers. Below are some of the key areas where technology is reshaping the domain of financial services:

1) Digital Banking

Digital banking has transformed how consumers interact with financial institutions, offering convenient and accessible banking services through online platforms and mobile applications. Cloud computing in banking solutions facilitates seamless account management, fund transfers, bill payments, and loan applications, empowering customers with greater control over their finances.

2) Data Analytics and AI

Data analytics and artificial intelligence (AI) empower financial institutions to derive valuable insights from vast data. AI-driven algorithms enable more accurate risk assessment, fraud detection, and personalized customer experiences. These technologies enhance decision-making processes and drive operational efficiency within financial organizations.

3) Cybersecurity Solutions

As digital transactions become more prevalent, cybersecurity in banking solutions is critical in safeguarding sensitive financial data and preventing cyber threats. Advanced encryption techniques, multi-factor authentication, and threat detection systems enhance the security posture of financial institutions, protecting customers’ assets and privacy.

4) Blockchain and Cryptocurrencies

Blockchain technology has introduced decentralized and transparent systems for financial transactions. Cryptocurrencies like Ethereum and Bitcoin leverage blockchain technology for protected and efficient peer-to-peer transactions. Blockchain can potentially streamline cross-border payments, asset tokenization, and smart contracts, revolutionizing traditional financial systems.

5) Digital Payment Technologies

The proliferation of digital payment technologies has accelerated the shift towards cashless transactions. Mobile payment solutions, digital wallets, and contactless payment methods offer consumers secure and convenient alternatives to traditional payment methods. These technologies drive IT in financial services technology inclusion and promote economic efficiency in digital transformation in banking.

6) Risk Management

Technology has revolutionized risk management practices in the financial services industry. Innovative risk assessment methodologies, such as social credit scoring and predictive analytics, enable organizations to assess and mitigate risks effectively. Real-time risk monitoring and automated decision-making processes enhance operational resilience and profitability.

7) Robo-advisory Services

Robo-advisory services leverage automation and AI algorithms to offer customers personalized investment advice and portfolio management services. These digital platforms offer cost-effective and accessible investment solutions, catering to a broader range of investors and optimizing investment strategies based on individual preferences and financial goals.

8) Analytics and Reporting

Data science and analytics enable financial institutions to leverage data-driven insights for strategic decision-making and risk management. Advanced analytics tools provide valuable information on customer behavior, market trends, and portfolio performance, enabling organizations to optimize operations and enhance customer satisfaction.

Technology is driving significant transformation across various facets of the financial services industry, enhancing efficiency, security, and accessibility for financial institutions and consumers. Embracing IT in financial services technology is essential for staying competitive and meeting the evolving requirements of the digital transformation in banking.

Useful Link: DevOps Adoption in Financial Services Industry – A Catchy Trend!

Future Prospects and Opportunities

Looking ahead, the future of financial technology companies promises even greater innovation and disruption. Emerging technologies like quantum computing, 5G networks, and the Internet of Things (IoT) are poised to transform finance by enabling faster transactions, enhanced connectivity, and real-time data insights. Moreover, the growing emphasis on sustainability and ESG (Environmental, Social, and Governance) factors drives the development of green finance solutions and impact investing platforms.

In addition to the transformative potential of emerging technologies, the financial industry is witnessing a shift towards sustainability and ethical investing. As awareness of environmental and social issues rises, so does the demand for financial products and services that adhere to ethical and sustainable principles.

This trend drives the development of green finance solutions, including renewable energy financing, carbon offsetting initiatives, and sustainable investment portfolios. Moreover, integrating ESG factors into investment strategies reshapes investors’ evaluation of risks and opportunities, leading to a more holistic approach to financial decision-making.

As the finance industry continues to evolve, these trends present new opportunities for innovation and collaboration, paving the way for a more sustainable and responsible financial ecosystem.

Conclusion

The finance industry’s reliance on information technology is profound and continuously evolving. Embracing innovation and leveraging emerging technologies like AI and blockchain will be essential for driving growth and sustainability.

Veritis, the recipient of prestigious awards such as the Stevie and Globee Business Awards, are committed to empowering financial institutions to thrive in the digital transformation in banking. From cybersecurity to data analytics, we partner with our clients to navigate the complexities of the modern financial sector, ensuring success in an ever-changing world. Together, we shape a future where technology enables financial institutions to achieve their goals and serve their customers more effectively.

Looking for Support? Schedule A Call

Also Read:

- Impact of AI in Telecommunications Industry

- 7 Essential AI Tools Every CTO Should Be Familiar With

- AIOps Vs MLOps: Understanding Significant Differences

- AI and Cybersecurity: Defending Against Evolving Threats

- AIOps Use Cases: How Artificial Intelligence is Reshaping IT Management

- Overcoming Challenges: Implementing Generative AI in Healthcare