Global M&A activity has reached $3.2 trillion in 2024 (PwC), with US companies leading nearly 45% of all deals worldwide. For CEOs and boards, mergers and acquisitions are no longer tactical moves; they are strategic levers of competitive advantage.

Short-term growth from operational tweaks, system upgrades, workflow improvements, or digital adoption is insufficient in today’s volatile market. Smart M&A advisory services deliver sustainable growth, accelerate digital transformation, and protect enterprise value in an era where 70% of deals fail to meet synergy targets (Bain).

This is why executive leaders increasingly rely on technology-driven Mergers and Acquisitions advisory partners to navigate complexity, mitigate risks, and ensure that acquisitions translate into measurable shareholder returns.

But how do firms bring about Mergers and Acquisitions in US?

Let’s take a look at the M&A process.

Talk To Our Mergers and Acquisitions Expert

When M&A Is the Right Lever

Leaders typically start Mergers and Acquisitions Advisory when they need one or more of the following:

- Entry into a new market or customer segment

- Access to strategic technology, data, or IP

- Supply-chain resilience or vertical integration

- Portfolio reshaping to exit non-core businesses

- Scale economics to improve margin and cash generation

McKinsey’s research shows that programmatic acquirers, those that do a steady stream of smaller, thesis-aligned deals, consistently generate excess total shareholder returns versus peers.

The Mergers and Acquisitions Advisory Process

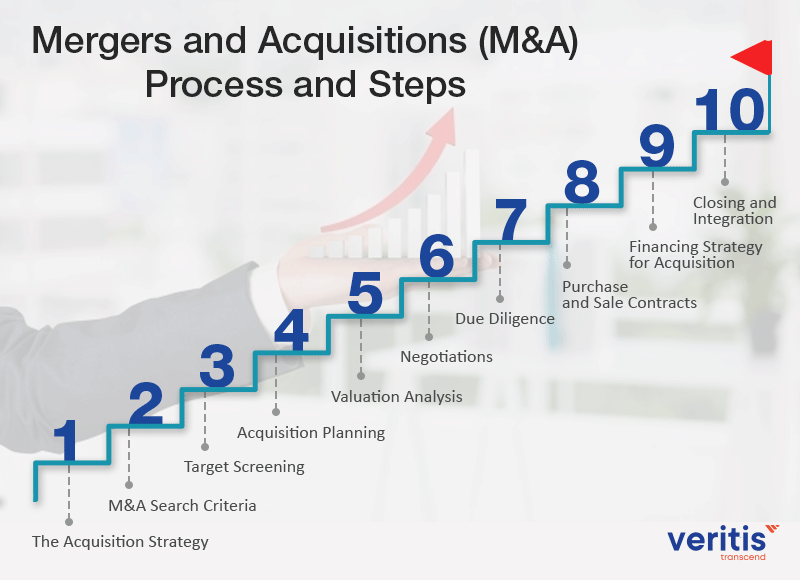

Technology Mergers and Acquisitions (M&A) Process and Steps:

1) The Acquisition Strategy

The first step is defining the strategic growth thesis. Whether the goal is expanding into new geographies, acquiring digital capabilities, or building resilience in the supply chain, clarity at the board level drives every decision.

Here are some questions to ensure a successful acquisition strategy:

- What business is the company involved in?

- What is the scope of the business?

- What overall direction does our business intend to take in relation to its market?

Deloitte reports that 62% of US CEOs prioritize capability driven acquisitions to accelerate competitiveness.

2) M&A Search Criteria

Advisory teams and corporate leaders establish benchmarks, revenue thresholds, geographic priorities, EBITDA margins, or compatibility with the acquirer’s digital transformation roadmap.

3) Target Screening

With today’s advanced AI driven deal sourcing platforms, screening is faster and more precise. McKinsey research shows that predictive analytics can cut evaluation time by 40% while increasing deal success probabilities.

4) Acquisition Planning

Early-stage engagement with potential targets focuses on leadership alignment, deal flexibility, and cultural fit, areas where many integrations falter if ignored.

5) Valuation Analysis

A holistic valuation approach goes beyond financial statements. It considers intellectual property, customer base, technology platforms, and cybersecurity readiness. Notably, ESG performance now shapes over one-third of investor decisions (PwC).

6) Negotiations

Negotiations are not just about numbers; they balance valuation with long-term enterprise integration risks, cultural alignment, and regulatory dynamics.

7) Due Diligence

Comprehensive diligence is non-negotiable. EY found that 47% of failed M&As trace back to insufficient diligence on technology or talent. Today, firms leverage digital tools to simulate integration risks and test financial scenarios.

8) Purchase and Sale Contracts

Well-structured agreements, whether asset or share purchases, optimize taxation, compliance, and value creation opportunities.

9) Financing Strategy for Acquisition

Deal financing strategies balance equity, debt, or private equity participation while safeguarding shareholder value.

10) Closing and Integration

Closing is not the finish line. Successful deals hinge on a merger integration strategy, covering technology harmonization, workforce transition, and synergy capture. McKinsey reports that companies with disciplined integration outperform peers by 23% in total shareholder return.

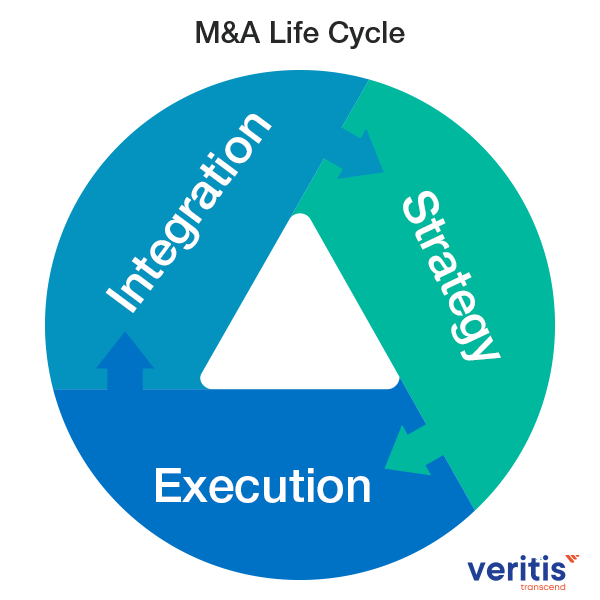

The Mergers and Acquisitions Life Cycle

The M&A life cycle, a crucial process in the corporate world, is best understood across three phases:

1) Strategy

- Defining portfolio strategy and investment priorities.

- Target screening and readiness review.

- Synergy analysis using digital models.

2) Execution

- Cross-functional M&A advisory teams manage finance, IT, HR, tax, and risk.

- Structured due diligence, valuation, and negotiation support.

- Technology M&A consulting ensures seamless digital and cloud integration.

3) Integration

- Cultural and leadership alignment.

- Integration of enterprise technology (ERP, CRM, cloud, cybersecurity).

- Compliance, restructuring, and Day 1 readiness.

- BCG finds that successful integrations drive 12% more EBITDA growth compared to peers.

Why Smart Tech Advisory Is Non-Negotiable for C-Suites

Traditional M&A advisory often fails to address the digital complexities. Smart Tech Advisory, on the other hand, comprehensively embeds cloud, data, cybersecurity, and AI considerations into the deal lifecycle, ensuring a secure and all-encompassing approach to M&A.

Benefits for US executives:

- Faster diligence: AI and predictive analytics reduce diligence timelines by 30–40%.

- Cyber resilience: Integration strategies that secure IP, cloud systems, and customer data.

- ROI visibility: Real-time synergy dashboards aligned to board reporting.

- Regulatory assurance: US-specific compliance with SEC, antitrust, and ESG mandates.

Veritis: Your Trusted Partner in Mergers and Acquisitions Advisory

With over 20 years of leadership in digital strategy and enterprise advisory, Veritis has supported Fortune 500 firms in navigating complex transactions. Recognized by the Stevie and Globee Awards, our team brings together M&A lifecycle expertise with technology integration strength.

We partner with CEOs, CFOs, and boards to:

- Design M&A strategies that deliver measurable ROI.

- Execute complex transactions with speed and precision.

- Lead post-merger integration with focus on people, processes, and platforms.

- Ensure compliance, resilience, and long-term enterprise value.

Considering your next merger or acquisition?