In the ever-changing terrain of the banking industry, the impetus for digital transformation has become increasingly vital. 8 factors that drive digital transformation in the banking industry encapsulate the key catalysts propelling this sector towards a digital future. These factors shape the industry’s competitive edge and redefine customer experiences and operational efficiencies.

Digital Transformation strategy enjoys deeper penetration across all industries, irrespective of the different end-user bases and other factors. Increasing usage of smart devices, improved connectivity, and demand for high-end user experience are among the key aspects driving the digital transformation trend, which brings services to the customer’s doorstep.

The digital revolution is reshaping the banking industry, paving the way for innovation and growth. According to MarketsandMarkets, the global digital banking platform market is projected to grow USD 13.9 billion by 2026, with a CAGR of 11.3%. This growth is driven by the demand for exceptional customer experiences and the adoption of cloud technologies.

A Statista study forecasts that 2.5 billion people will use online banking services by 2024, highlighting the profound impact of digital advancements. Digital transformation in banking includes innovations like online banking apps, data encryption software, virtual assistants, advanced KYC systems, and optimized websites.

Historically, banking was a segmented process, often leaving customers feeling disconnected. Today, digital tools integrate customer data, streamline interactions, and personalize marketing, creating a seamless and efficient customer journey. AI-driven chatbots, automated workflows, and proactive customer service enhance convenience and satisfaction. Enhanced security and innovative financial products offer tailored solutions and build customer trust.

At Veritis, we advocate digital transformation to build stronger connections and drive growth. By embracing these changes, digital transformation for banks can deliver efficient and highly personalized experiences. Let’s take this exciting journey together—transforming banking, one digital step at a time.

Digitally Transform Your Business

What is Digital Transformation in Banking?

Digital transformation in banking and financial services signifies the seamless integration of technology into various facets of banking operations. It ushers in a profound shift in how banks operate and provide value to their clientele. When executed precisely, this transformation empowers banks to enhance their competitive edge within a saturated market field.

Adopting digital banking innovation platforms enables banks to provide diverse digital transformation in financial services through various channels, ensuring accessibility to customers wherever they may be. This software has significantly facilitated the shift of conventional brick-and-mortar banks toward the digital realm, making the transition notably seamless.

The fundamental nature of banking remains unaltered mainly, but the industry’s dynamics in customer interaction have undergone a substantial transformation.

Useful link: Successful Digital Transformation: CEO’s Path to Digital Transformation Success

Examples of Digital Transformation in Banking

The functioning of the banking sector has been reshaped by the digital transformation in finance industry, ushering in a range of fresh use cases, such as:

1) Mobile Banking

Digital transformation within the banking industry extends beyond mere payment transactions and peer-to-peer fund transfers. Mobile banking empowers customers with the capability to manage their bank accounts and online financial activities seamlessly via smartphone applications. This comprehensive access encompasses reviewing account details, monitoring daily transactions, managing investments, accessing customer support services, and staying updated with financial news.

2) Digital Account Opening

Banks have streamlined the account opening process by implementing automation, which shortens the time required to initiate a new bank account and diminishes the manual tasks that employees have to undertake. Consequently, employees can allocate more of their time to delivering additional value to clients, making it a prime illustration of how digital engagement is enhanced throughout the customer journey while reducing the necessity for in-person branch visits.

3) Digital Payments

Financial institutions have integrated digital payment systems into their offerings, encompassing online transactions, mobile payments, and digital wallets. This allows customers the flexibility to conduct transactions and money transfers using their smartphones or computers. Digital payments have effectively consolidated mobility and convenience onto a unified platform, empowering customers with enhanced control and transparency in their financial digital transformation activities.

Transforming the Customer Journey in Banking

In today’s financial digital transformation era, every bank boasts a website, a digital app, and a suite of online services. These digital features often come to mind when we think of “digital services.” However, they merely scratch the surface of what true digital transformation in banking entails. The real game-changer is digitizing the customer journey, propelling digital transformation for banks toward a future of seamless, personalized experiences.

The Power of a Digitized Customer Journey

Imagine a customer journey that feels like a warm, personal handshake rather than a series of formal handoffs. Traditional banking models often lead customers through a labyrinth of departments—marketing generates leads, sales nurtures them, and customer service steps in post-purchase. This segmented approach can feel disjointed and impersonal.

Digital transformation in banking and financial services revolutionizes this experience. Banks can create a cohesive, customer-centric journey by integrating advanced technologies and innovative processes. Here’s how:

1) Unified Customer Data

Digital transformation allows for the consolidation of customer data across all touchpoints. This unified view empowers bank representatives to understand customer needs deeply and offer personalized solutions at every stage of their journey.

2) Seamless Interactions

Through AI-driven chatbots and smart automation, customers receive prompt responses to their inquiries 24/7, anywhere. This not only enhances convenience but also builds trust and satisfaction.

3) Personalized Marketing

Financial institutions can leverage advanced data analysis to personalize their services and product offerings, tailoring them to individual customers’ unique requirements and preferences. Personalized recommendations and offers make customers feel valued and understood.

4) Efficient Sales Processes

Digital tools streamline the sales pipeline, reducing customer friction. Automated workflows and CRM systems ensure no lead falls through the cracks, transforming prospects into loyal customers more efficiently.

5) Proactive Customer Service

Predictive analytics and real-time monitoring enable proactive customer support. Instead of waiting for issues to arise, banks can predict customer needs and address issues proactively before they affect the customer.

6) Enhanced Security

Advanced digital solutions provide robust security measures, safeguarding customer data and transactions. Features like biometric authentication and real-time fraud detection offer reassurance and build customer trust.

Technologies That Drive Digital Transformation in Banking

The effective execution of a digital transformation strategy necessitates the utilization of cutting-edge technology. Now is the opportunity to acquaint yourself with the current trends in digital banking innovation.

1) Artificial Intelligence and Machine Learning

Artificial intelligence (AI) has significantly altered the functioning of the banking and financial sectors, introducing innovations like chatbots, online assistants, data analysis, and predictive capabilities. Machine learning (ML) also collaborates with data to enhance fraud detection. In real-time, it gathers, retains, and cross-references customer data to pinpoint unusual deviations, offering timely suggestions for preventive actions.

2) Blockchain

Any discourse concerning digital transformation within the banking and digital transformation in financial services sphere is inadequate without addressing the impact of blockchain technology. The adoption of blockchain in banking services has brought about augmented transparency, secure digital customer identity transactions, and an improved user interface.

3) Internet of Things (IoT)

IoT plays a pivotal role in enabling actions such as biometric sensor-based authorization, asset tracking and monitoring, delivery of location-based services, and contactless payments. It customizes and individualizes customer experiences by harnessing real-time data analysis. Moreover, IoT has ushered in risk management practices and opened doors to diverse platforms through seamless data exchange.

4) Cloud Computing

Banks have transitioned from initial resistance to embracing the inevitability of cloud-based services. Cloud computing empowers banks to develop solutions featuring applications and infrastructures that enhance their operational efficiency. Furthermore, cloud-driven services yield heightened productivity and enable the swift delivery of products and services.

5) Big Data Analytics

Banks’ operations have evolved significantly over the past decade, and big data is a crucial catalyst for this transformation. From scrutinizing customer spending habits to risk assessment and feedback management, big data technology has elevated the progress within the banking sector to a whole new level.

Useful link: What is a Digital Transformation Strategy?

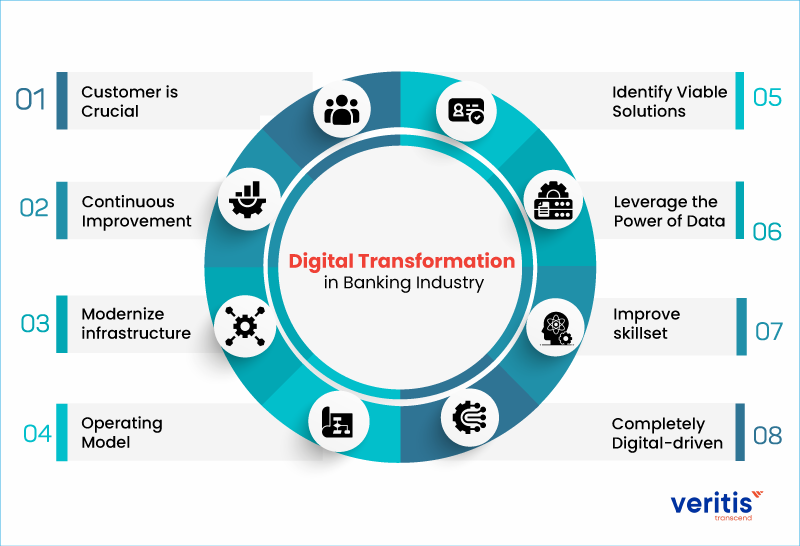

8 Key Factors for a Successful Digital Transformation Journey in the Banking Industry:

1) Customer is Crucial

Understand and analyze what the customer is looking for. Seamless service delivery, high-end user experience, personalized product experience, transparency, and security are the core of customer satisfaction in today’s fast-changing market trend. It has become imperative for organizations to adopt a ‘customer-first’ approach to achieve success in this competitive scenario.

Bring about changes in operating procedures, introduce digital platforms in service offerings, enhance customer interaction procedures, and more. All these activities enhance your service delivery and boost customer engagement with your business, the key driver behind any business success.

And digital transformation strategies are about making things simple and current. In this age of the Internet of Things, digital transformation is vital to stay ahead of the competition. The digital transformation banking strategy has to be customized to the customer’s needs. Post-Covid, most of the customer bases have become reliant on digital technologies, and it is all-important to reinvent your aging, legacy infrastructures before your competition overtakes you.

2) Continuous Improvement

A seamless innovation delivery pipeline built on agile principles is key to continuous improvement. The pipeline should be so effective that it can easily track changing market trends, test innovative products, and facilitate fast feedback mechanisms to iterate products for enhancements. This cycle contributes to on-demand service delivery, continuous innovation, and continuous improvement, accelerating time-to-market.

With an increased appetite for digital products, reliability, and robustness are expected. Your digital transformation strategy and tools should foster growth instead of complicating things with jargon and techniques that are not required in the first place. One should understand that digital products need and demand continuous improvement. If one ignores the continuous refinement, the products will no longer be future-proof, and the deliverables risk becoming outdated. So, by harnessing the inputs of your customers and quashing out the bugs in the deliverables, your products, which have been built on your unique digital transformation strategy, should be bettered using value engineering.

3) Modernize infrastructure

Achieving digital transformation is not just about introducing digital transformation technologies. The underlying infrastructure facilitates the information flow key to the front-end digital transformation journey. So, it’s important to modernize your legacy infrastructure to support digital transformation strategies.

We have to understand that the world has become increasingly interconnected. Given the digital transformation strategies that have fostered digital innovation, change is happening faster than ever. These digital transformation trends are difficult to cope with, and the companies that have their hands full rope in MSPs, such as Veritis, to execute digital transformation strategies.

Microservice architecture, APIs, and DevOps can help with continuous integration and delivery, resulting in shorter release cycles.

4) Operating Model

Now, customers need a hybrid experience, a combination of never-seen digital experience in terms of speed and convenience and the personal look and feel of the product. This is possible by transforming the business in three different digital transformation technology models:

- Digital as Business – At the management level

- Digital as New Line of Business – At the next level, a separate digital division to take care of digital activities

- Digital Native – New setup with its technology stack, focusing directly on customers.

Various digital business transformation models are available. However, selecting the right one requires due diligence and expertise. These factors influence most innovative enterprises to seek the digital transformation services of Stevie Award winner Veritis.

Useful link: Guide to Digital Transformation Technologies and Their Business Impact

5) Identify Viable Solutions

Ensure you do not miss out on anything while executing the digital transformation strategy. Even the things you feel obsolete can make a crucial contribution. Identify and leverage the potential of all the minimum viable digital transformation solutions and introduce them across the digital transformation services. Ensure the effective and best utilization of existing options, too.

Digital transformation technologies often sway enterprises and take on too many digital transformation tools. This results in unwanted expenses, and the solutions that needn’t be modernized are unwantedly bogged down by these digital transformation technologies.

6) Leverage the Power of Data

Banking institutions should realize the power of data and related tools and resources in driving business success. They must consider implementing data analytics practices to understand and monitor customer thinking patterns. This helps them produce the most relevant products that match customer needs.

This will also help them gain critical market insights, which can further assist them in enhancing product offerings and experiences and deepening customer relationships.

7) Improve skillset

As the World Economic Forum’s report shows, over 55% of finance sector employees must upgrade their skill set to fulfill existing and changing operational demands. Digital transformation services have the potential to cater to these needs. The drive for improved skillsets for enterprise digital transformation will require necessary investment in changing operating culture, thinking patterns, the culture of learning, skillset training, and more across the teams.

8) Completely Digital-driven

Finally, the organization should possess all digital capabilities, such as strategy, culture, relevant technologies, funding, skillset, and more, contributing to a complete digital transformation journey. The digital transformation strategy should also factor in the latest trends and provide a digital transformation framework based on customer requirements. Learn from the experiences, adopt best practices, and develop a perfect digital strategy.

Conclusion

More than enthusiasm, a perfect digital transformation journey should ideally begin with a well-planned strategy backed by a clear vision. Go with stepwise implementation, make priority-wise investments, and spread the culture across cross-functional teams to achieve the desired results.

However, overhauling the infrastructure with digital banking transformation technologies is an arduous task, and that’s why companies of various sizes from different sectors hire Veritis, a Stevie Award and Globee Business Award winner, to execute the digital transformation strategy. Contact us, and we will help you along the digital transformation journey.

Got Questions? Schedule A Call

Additional Resources:

- What Technologies Enable Digital Transformation?

- Data Strategy – A Key Checklist for Digital Transformation

- Digital Transformation Stands Crucial to ‘MedTech’ Industry

- Business Transformation Vs. Digital Transformation: A Thin Line of Difference!

- How to Implement Artificial Intelligence in DevOps Transformation?