The start of 2024 prompts questions about the financial services industry’s future amid rapid technological advancements. Persistent concerns about high-interest rates and inflation linger, emphasizing the need to stay updated on banking and capital markets trends for real-time adaptation.

Gartner foresees platform investment hitting USD 250 billion by 2026, underlining the importance of platform-based strategies. This growth signals an exciting future for the financial sector. In 2024, financial services focus on cost reduction, revenue acceleration, enhanced customer experience, and bolstering security and compliance frameworks amid ongoing challenges.

Strategic technology investments are crucial, enhancing resilience and future-proofing businesses. The industry’s recognition of platform-based strategies instills optimism, promising significant growth. Money undergoes transformative changes, shaping our relationship with it.

Six transformative trends are poised to redefine the financial sector in the contemporary era. Let’s explore these trends.

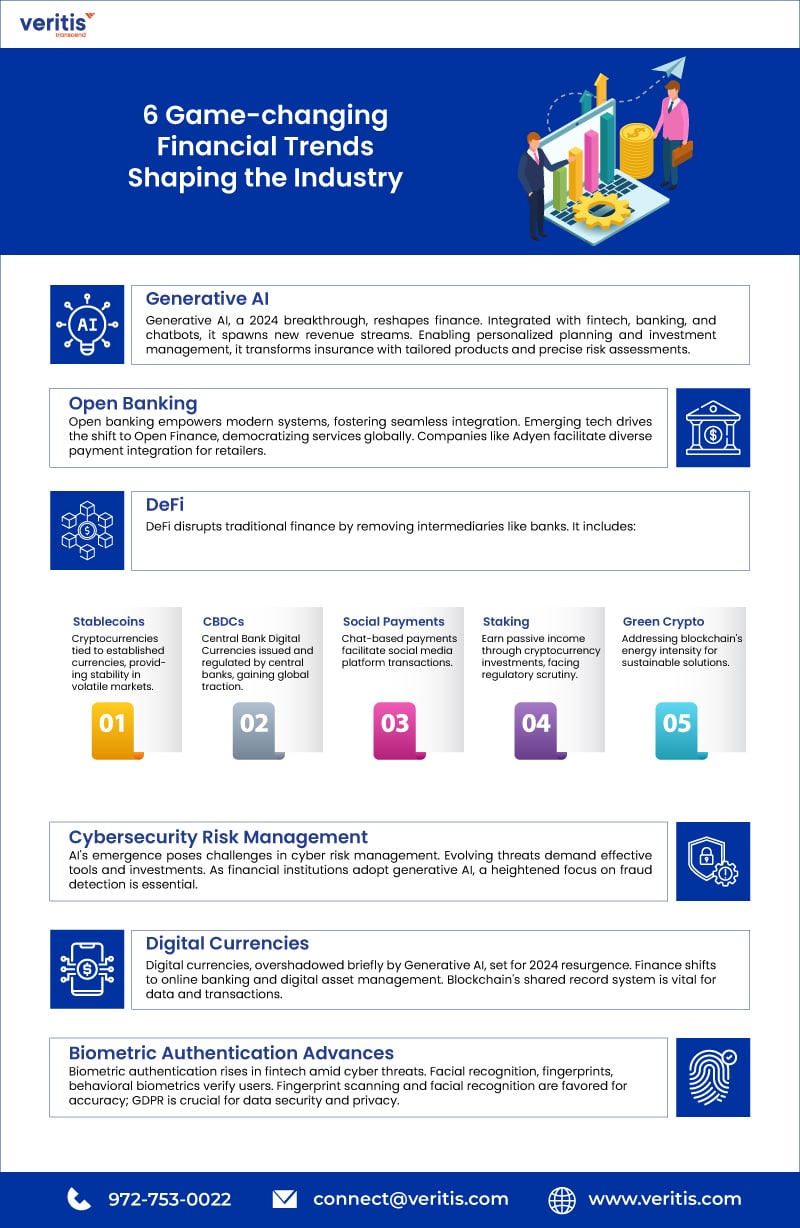

6 Game-changing Financial Trends Shaping the Industry

Email-us: connect@veritis.com; Call: 972-753-0022

Top 6 Biggest Future Trends in the Financial Sector

1) Generative AI

Generative AI, a 2024 breakthrough, reshapes finance. Integrated with fintech, banking, and chatbots, it spawns new revenue streams. Enabling personalized planning and investment management, it transforms insurance with tailored products and precise risk assessments.

2) Open Banking

Open banking empowers modern systems, fostering seamless integration. Emerging tech drives the shift to Open Finance, democratizing services globally. Companies like Adyen facilitate diverse payment integration for retailers.

3) DeFi

DeFi disrupts traditional finance by removing intermediaries like banks. It includes:

A) Stablecoins: Cryptocurrencies tied to established currencies, providing stability in volatile markets.

B) CBDCs: Central Bank Digital Currencies issued and regulated by central banks, gaining global traction.

C) Social Payments: Chat-based payments facilitate social media platform transactions.

D) Staking: Earn passive income through cryptocurrency investments, facing regulatory scrutiny.

E) Green Crypto: Addressing blockchain’s energy intensity for sustainable solutions.

4) Cybersecurity Risk Management

AI’s emergence poses challenges in cyber risk management. Evolving threats demand effective tools and investments. As financial institutions adopt generative AI, a heightened focus on fraud detection is essential.

5) Digital Currencies

Digital currencies, overshadowed briefly by Generative AI, set for 2024 resurgence. Finance shifts to online banking and digital asset management. Blockchain’s shared record system is vital for data and transactions.

6) Biometric Authentication Advances

Biometric authentication rises in fintech amid cyber threats. Facial recognition, fingerprints, and behavioral biometrics verify users. Fingerprint scanning and facial recognition are favored for accuracy; GDPR is crucial for data security and privacy.

Conclusion

In 2024, FinTech will evolve rapidly with trends like Generative AI, open banking, and DeFi. This transformation impacts service delivery, challenging institutions to balance innovation with ethical AI practices, data privacy, and cybersecurity. Adapting and leveraging technology is crucial for sustainable growth in finance’s digital future. Contact Veritis, Stevie, and Globee Business Awards winner for FinTech innovation guidance.

Got Questions? Schedule A Call

Additional Resources:

- The Future of IT Financial Management: Trends and Innovations

- Impact of Information Technology on the Financial Industry

- 5 Key Benefits of Implementing Cloud Financial Services for Your Business

- How Veritis Anticipates and Resolves Financial Service Challenges

- How Financial Risk Management Software Mitigates Fraud in the Financial Industry

- 5 Reasons Why Financial Sector Needs Identity and Access Management (IAM)

- The Rise of Artificial Intelligence and Machine Learning in Financial Decision Making Processes