The fast-growing market pace and the need to survive in competition has driven many firms to device several growth strategies.

Firms upgrade existing systems, improvise workflows, adopt new technologies and more, which are enough to achieve short-term growth goals. However, strategies such as M&A help firms achieve long-term.

Big business strategies like Mergers and Acquisitions (M&A) not only give the organizations the impetus for growth but also place these business giants at the forefront of competition.

But how do firms bring about a merger or acquisition in the US?

Let’s take a look at the M&A process.

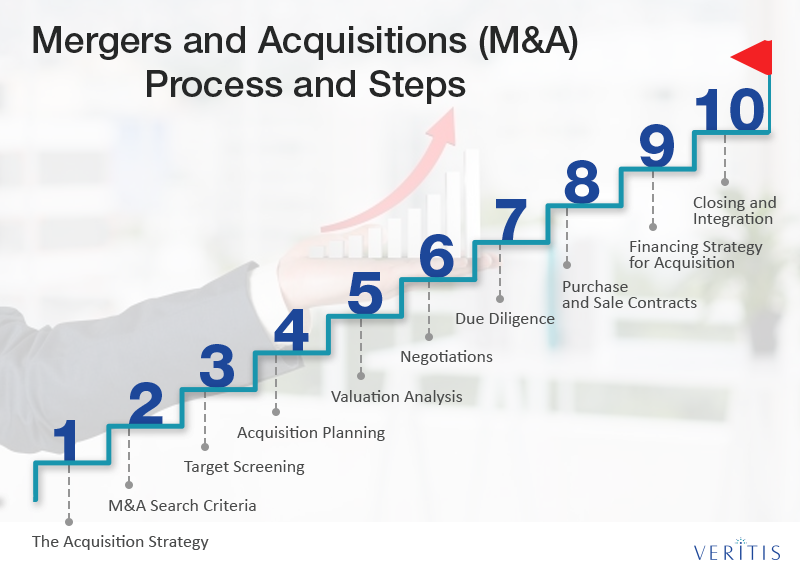

Technology Mergers and Acquisitions (M&A) Process and Steps:

1) The Acquisition Strategy

The first step in the M&A process is creating a good acquisition strategy! This requires the acquiring company to have a clear idea of what goals they want to achieve from the acquisition – expand product lines or gain access to new markets.

Here are some questions to ensure a successful acquisition strategy:

- What business is the company involved in?

- What is the scope of the business?

- What is the overall direction that our business intends to take toward its market?

These questions will bring your M&A strategy in line with the overall business strategy in the US.

2) M&A Search Criteria

The next step is to identify key criteria for target companies in line with the acquiring firm’s acquisition goals. The criteria could vary based on customer base, geographic location and profit margins.

3) Target Screening

The acquiring firm then begins target screening by assessing the potential targets in line with the acquisition criteria

4) Acquisition Planning

The acquirer will then meet with the target companies and offer a good value for them or their assets. With the initial meeting, the acquiring firm will seek to gain information about the target and see how flexible is the target company with a merger.

5) Valuation Analysis

After the initial conversation, the acquiring firm will ask the target to provide substantial information including current financials, operations, liabilities and more. This helps the acquirer to assess the target’s capabilities as a business on its own and as a potential acquisition firm.

6) Negotiations

After gathering enough information for the evaluation of the target, the initial offer will be rolled out. Then the two firms will negotiate terms in further detail.

7) Due Diligence

This process begins as soon as the offer has been accepted by the buyout company. This makes a reevaluation of the acquirer’s initial assessment of the target’s value by conducting a detailed analysis of the target’s operations such as assets, customers, human resources and more. Due diligence is a concrete step that leaves no room for future concerns or problems

8) Purchase and Sale Contracts

In this stage, a final contract for sale is set up, where both the companies make a decision on the type of purchase agreement – asset purchase or share purchase.

9) Financing Strategy for Acquisition

While the acquiring firm has already considered its financials in the early stages of the deal, the fine details of the financials are put in place only after the purchase and sale agreement has been signed.

10) Closing and Integration

The acquisition deal is closed and representatives of both the firms work together on the merger.

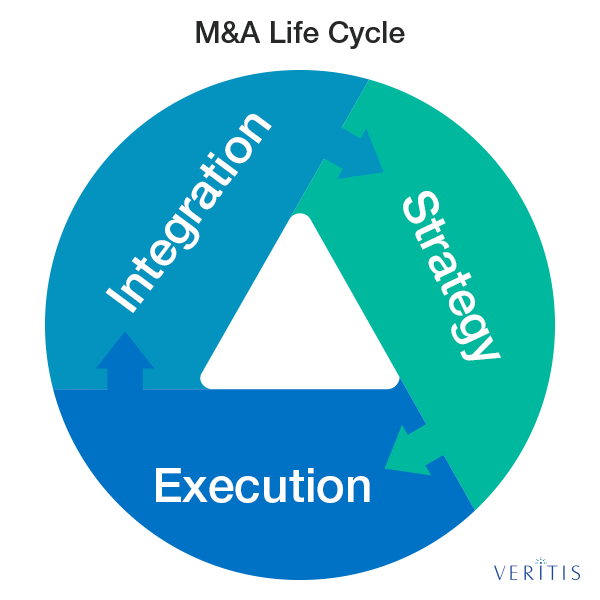

The Mergers and Acquisitions (M&A) Life Cycle

The M&A life cycle categorizes the different M&A processes stages into three broad phases:

1) Strategy

Under this phase, M&A Advisors in the US assess the changes pertaining to the acquirer’s industry and identify growth opportunities and targets in line with the firm’s corporate strategy.

This encompasses creating a portfolio strategy and an operating model assessment, corporate financing or investment banking and strategic alternatives.

Besides, this stage also covers target screening, deal structuring, readiness review, synergy analysis and modeling.

2) Execution

During the execution phase, M&A expert advisors in commercial, financial, HR, IT, operational and tax aspects provide insight into the transition and financing options. The execution phase combines experience and knowledge to bring closure to the complex process.

This stage covers, plan structuring, financial advisory, negotiation support, due diligence, preliminary price allocation, tax structuring and more.

3) Integration

In the final phase, integration or separation will present the acquirer with a set of challenges including costs, timelines and business disruptions, among others. This phase spans integration or separation planning support, developing the sales purchase agreement, financial agreement advisory, finalizing valuation and purchase price, completion statement advisory.

Post-deal closure, M&A advisors organize Day 1 Readiness Transition Service Agreement, synergy support, human capital integration, tax integration and restructuring. Technology M&A Advisors in the US assure of a hassle-free process all throughout the integration phase including end-state planning.

The M&A process brings a series of benefits for both the acquirer and target companies if carried out in a phased and strategic manner. Assessment, evaluation and reevaluation are key to the process at every step, without which the merger or separation can turn out to be unfruitful for both firms.

Above all, strong advisory support can transform the daunting process of M&A into a much-organized system. Considering a merger?

Looking for a reliable IT advisory service partner in the US? Contact Veritis!

Related Post: