Table of contents

Financial institutions have a long history spanning centuries, during which the banking domain has evolved significantly. Despite the transformative changes in banking practices, the fundamental principles have endured. Historically, banks have maintained extensive repositories of personal and financial data belonging to their clientele. In contemporary times, digitizing these records has made them more accessible, necessitating stringent cybersecurity services in banking protocols to safeguard sensitive information and strengthen bank data security frameworks across all operations.

- CEOs and CFOs must recognize that digital transactions bring both opportunity and risk, making cybersecurity for banks a board level priority to protect customer trust, shareholder value, and reduce exposure to cybersecurity risks in banking.

- CIOs and CTOs need to modernize legacy systems and adopt cloud driven managed data services to ensure resilience, agility, and regulatory compliance while strengthening bank network security and preventing cybersecurity breaches in banking.

- CISOs and CROs play a critical role in implementing encryption, MFA, continuous monitoring, and fraud detection to prevent financial loss and reputational damage, ensuring proactive cybersecurity in financial services.

- All executives must view cybersecurity and financial services not as a cost center but as a strategic enabler of digital transformation, fintech adoption, and long term competitiveness, reinforcing trust in the cybersecurity in banking industry.

The proliferation of financial technology (fintech) has spurred numerous advancements and transformations in the cybersecurity in banking industry over recent decades. Innovations such as wire transfers, credit/debit cards, online banking, and mobile payments have reshaped the industry. As a result, banks have had to upgrade their infrastructures to accommodate these innovations and revamp their operational processes to uphold security standards when integrating new technologies.

Protecting sensitive data and implementing robust security measures to thwart cyber threats like phishing and malware attacks have become paramount in the modern banking environment. Banks are tasked with the legal obligation of safeguarding customer information, strengthening data security in banking industry, and fortifying defenses against cyber intrusions or unauthorized access. Effective cybersecurity in banking strategies, combined with advanced bank data security practices, is now central to maintaining resilience and mitigating cybersecurity risks in banking that threaten trust, reputation, and compliance.

The Rise of Digital Transactions

Digital transactions have revolutionized the banking industry, allowing customers to transfer funds, pay bills, and manage their finances with just a few clicks. While this has undoubtedly improved convenience and efficiency, new opportunities have emerged for cybercriminals to exploit cybersecurity weaknesses in banking, secure payment systems, and online banking platforms.

These gaps highlight the growing cybersecurity risks in banking and the crucial need to strengthen bank data and network security to prevent breaches and stay aligned with emerging cybersecurity trends.

Understanding the Cyber Threat Field

Cybersecurity in banking encompasses various threats, including phishing, malware, ransomware, and DDoS (Distributed Denial of Service) attacks. These cybersecurity risks in banking can lead to monetary losses, harm to reputation, regulatory penalties for banks, and the possible exposure of sensitive customer information, making bank data security and data security in banking industry critical priorities.

Useful Link: The Future of IT Financial Management: Trends and Innovations

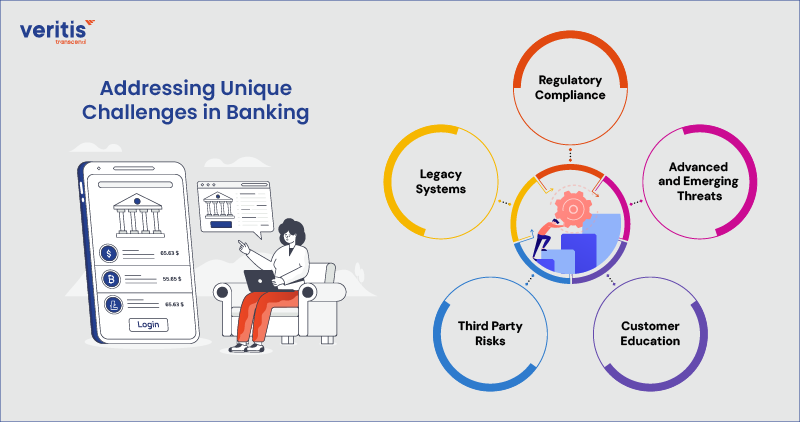

Addressing Unique Challenges in Banking

1) Regulatory Compliance

Financial institutions operate under strict compliance frameworks, such as GDPR and PCI DSS, to ensure the security and privacy of customer data. Non compliance can result in severe penalties, highlighting the importance of robust cybersecurity in banking measures and strict data security in banking industry standards.

Veritis Solution: Veritis provides cybersecurity in financial services frameworks with automated compliance monitoring, audit ready reporting, and regulatory alignment, ensuring banks meet evolving mandates without disrupting operations.

2) Legacy Systems

Numerous banks rely on outdated IT systems, which may not have the essential security capabilities to withstand contemporary cyber threats. Retrofitting these systems with advanced bank data security and bank network security controls is crucial to protect against cybersecurity breaches in banking.

Veritis Solution: Veritis modernizes legacy environments by integrating cloud ready architectures, deploying enterprise managed data solutions, and embedding zero trust security models to eliminate vulnerabilities.

3) Third Party Risks

Banks often collaborate with third party vendors for various services, introducing additional cybersecurity risks in banking. To mitigate potential risks, it’s essential to vet these vendors thoroughly and ensure they adhere to stringent cybersecurity for banks and cybersecurity in financial services standards.

Veritis Solution: Veritis delivers vendor risk management programs built on effective risk mitigation strategies, featuring real time monitoring, contract enforcement, and continuous assessment of third party ecosystems to reduce exposure.

4) Customer Education

Educating customers about cybersecurity best practices is paramount in safeguarding digital transactions. Banks must raise awareness about common threats like phishing scams and encourage customers to use multi factor authentication and strong passwords, reinforcing the value of cybersecurity and financial services across the broader cybersecurity in banking industry.

Veritis Solution: Veritis develops enterprise wide cybersecurity awareness campaigns, employee training modules, and customer engagement strategies to reduce human error driven incidents.

5) Advanced and Emerging Threats

With the rise of AI driven cyberattacks, quantum computing risks, and evolving malware, banks face unprecedented cybersecurity in banking industry challenges that outpace traditional defenses. These threats endanger trust, compliance, and long term competitiveness.

Veritis Solution: Veritis provides proactive threat intelligence, AI powered anomaly detection, and advanced SOC (Security Operations Center) capabilities to help banks stay ahead of sophisticated cyber adversaries.

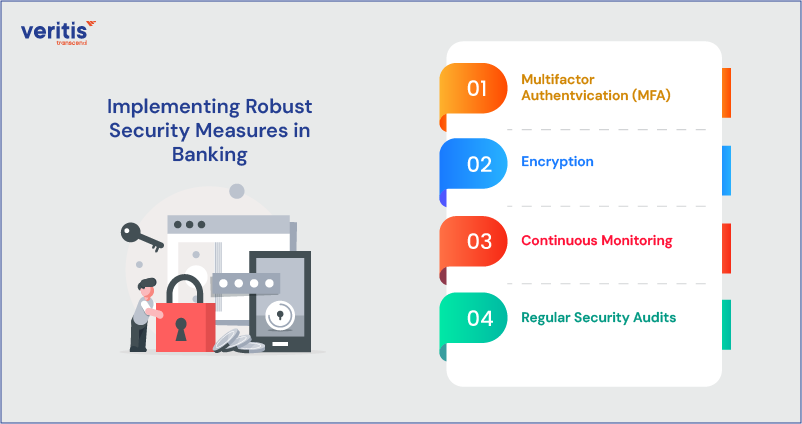

Implementing Robust Security Measures in Banking

To reduce the cybersecurity risks in banking related to digital transactions, banks can implement the following measures to strengthen bank data security, bank network security, and overall data security in banking industry frameworks:

1) Multifactor Authentication (MFA)

Introducing Multi Factor Authentication (MFA) enhances cybersecurity in banking by mandating users to provide multiple verification methods before gaining access to their accounts. This is a critical safeguard in cybersecurity for banks, ensuring compliance with cybersecurity in financial services standards.

2) Encryption

Securing confidential data during transmission and while stored protects it from unauthorized access. Strong encryption techniques make intercepted data inaccessible to unauthorized users, reducing exposure to cybersecurity breaches in banking and elevating data security in banking industry practices.

3) Continuous Monitoring

Financial institutions should utilize robust monitoring systems to identify and address threats promptly in real time. Automated alerts help detect suspicious activities and prevent cybersecurity breaches in banking before they escalate, reinforcing trust in cybersecurity in banking industry and advancing bank network security resilience.

4) Regular Security Audits

Ongoing security evaluations and penetration tests play a key role in revealing vulnerabilities within banking networks. Addressing these vulnerabilities strengthens the bank’s overall cybersecurity in financial services posture, ensuring executives meet compliance demands while minimizing cybersecurity risks in banking.

Useful Link: 8 Factors That Drive Digital Transformation in Banking Industry

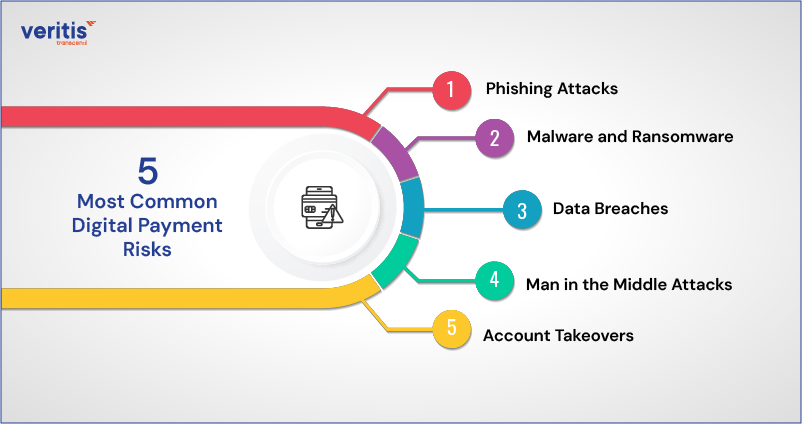

5 Most Common Digital Payment Risks

1) Phishing Attacks

Cybercriminals use deceptive emails, messages, or websites to trick users into revealing sensitive information, including credit card numbers, personal identification, login credentials, and other details. These attacks are a major driver of cybersecurity risks in banking and highlight the need for stronger cybersecurity in financial services.

2) Malware and Ransomware

Malware can compromise a user’s system and harvest sensitive financial data, compromise security, or hold data for ransom, leading to financial loss or identity theft. Such attacks remain one of the top causes of cybersecurity breaches in banking, undermining bank data security and bank network security.

3) Data Breaches

Unauthorized access to a company’s database or payment processing system can result in the theft of sensitive customer data, including credit card numbers, names, and addresses, leading to potential fraud and financial losses. Preventing these breaches is central to data security in banking industry and maintaining trust in cybersecurity for banks.

4) Man in the Middle Attacks

Hackers intercept communications between users and the payment gateway, allowing them to eavesdrop on sensitive information or modify transaction details, leading to unauthorized payments or identity theft. This underscores the urgency of enhancing cybersecurity in banking industry protocols to defend digital transaction flows.

5) Account Takeovers

Cybercriminals gain unauthorized entry into a user’s account through stolen credentials or brute force attacks, enabling fraudulent transactions or theft of personal information. These incidents highlight systemic cybersecurity risks in banking and the importance of proactive cybersecurity and financial services solutions.

Addressing these risks requires robust cybersecurity in banking measures, including encryption, multi factor authentication, regular security updates, employee training, and adherence to industry regulations and best practices. Moreover, users should remain vigilant, avoid sharing sensitive information with untrusted sources, and monitor their accounts for suspicious activity to strengthen bank data security and overall cybersecurity in banking industry resilience.

Useful Link: The Rise of Artificial Intelligence and Machine Learning in Financial Decision Making Processes

Use Cases for Cybersecurity in Action

1) Phishing Prevention with AI Powered Filters

Phishing continues to drive most cybersecurity breaches in banking. Intelligent filters powered by machine learning stop suspicious messages before they reach customers. This strengthens cybersecurity in banking and protects bank data security at scale.

2) Real Time Transaction Monitoring

Every fraudulent transaction damages trust. Real time monitoring detects anomalies and prevents financial loss. It reinforces cybersecurity in financial services, thereby reducing cybersecurity risks in banking that affect compliance and profitability.

3) Endpoint Security and Zero Trust Adoption

Banks must secure every device to prevent attacks. Endpoint protection combined with Zero Trust reduces ransomware threats and insider breaches. This creates a stronger foundation for bank network security and data security in banking industry standards.

4) Secure Mobile Banking Applications

Mobile transactions are now the primary channel for customers. Applications must include biometric authentication and encrypted access to preserve loyalty. Strong mobile security confirms cybersecurity for banks and meets the demands of cybersecurity in banking industry frameworks.

5) Vendor Risk Management and Third Party Assurance

Weak third parties create unacceptable vulnerabilities. Vendor oversight, audits, and compliance controls are essential. Enforcing cybersecurity and financial services standards protects bank data security and reduces exposure to cybersecurity breaches in banking.

6) Incident Response and Resilience Planning

Resilience is now a competitive advantage. Banks require clear response strategies that contain breaches and protect operations. Strong planning demonstrates leadership, meets regulatory standards, and prevents the escalation of cybersecurity risks in banking.

7) Continuous Security Training and Culture Building

Employees remain the first line of defense. Ongoing training builds a culture of awareness that reduces human error. A strong security culture directly addresses cybersecurity in banking industry challenges and minimizes data security in banking industry risks.

8) Cloud Security and Compliance in Banking

Cloud adoption is accelerating. Encryption, monitoring, and strict compliance guardrails secure workloads. Strong governance ensures cybersecurity in banking and delivers trusted cybersecurity in financial services while maintaining customer confidence.

Useful Link: 5 Key Benefits of Implementing Cloud Financial Services for Your Business

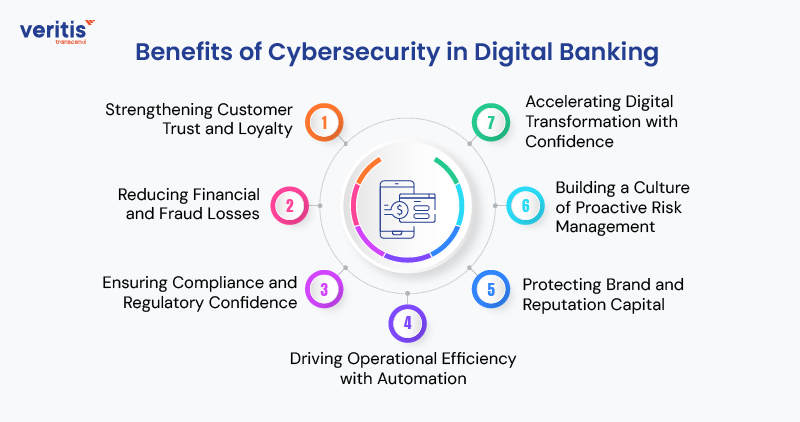

Benefits of Cybersecurity in Digital Banking

1) Strengthening Customer Trust and Loyalty

Robust cybersecurity in banking gives customers the confidence that their information and money are safe. Trust is the foundation of growth, and secure digital transactions reinforce loyalty while positioning the bank as a leader in the cybersecurity in banking industry.

2) Reducing Financial and Fraud Losses

Cyberattacks can erode profitability, but adequate safeguards prevent them from becoming business threats. Proactive measures reduce cybersecurity breaches in banking, protect against fraud, and secure shareholder value. Strong bank data security frameworks backed by advanced data security in banking industry practices build long term resilience.

3) Ensuring Compliance and Regulatory Confidence

Regulatory expectations continue to rise across global markets. Meeting and exceeding cybersecurity for banks requirements reduces the risk of penalties and strengthens confidence with regulators. Alignment with leading cybersecurity and financial services standards demonstrates accountability and sound governance.

4) Driving Operational Efficiency with Automation

Automated monitoring and real time detection improve efficiency while lowering costs. Streamlined operations strengthen cybersecurity in financial services and free resources for innovation and customer focused initiatives.

5) Protecting Brand and Reputation Capital

Reputation is one of the most valuable assets in banking. Preventing cybersecurity risks in banking ensures that institutions avoid headline grabbing breaches that undermine trust. Strong preventive measures maintain confidence among customers, investors, and regulators.

6) Building a Culture of Proactive Risk Management

Cybersecurity is not only about technology, it is about mindset. Ongoing awareness programs and leadership visibility strengthen bank network security and resilience. Institutions that embed security into culture minimize vulnerabilities and ensure continuity.

7) Accelerating Digital Transformation with Confidence

Innovation demands trust. With a strong cybersecurity foundation, banks can confidently expand fintech, cloud, and mobile services while protecting customer data. Embedding cybersecurity in financial services ensures digital transformation happens securely and at scale.

Case Study: Building a Resilient Cybersecurity Framework in the Digital Services Sector

Veritis collaborated with a fitness and wellness platform to implement a comprehensive cybersecurity transformation. The goal was to protect sensitive user data and digital transactions. Although the project was specific to the wellness industry, the security challenges it addressed, such as safeguarding digital payments, securing user credentials, and defending against evolving cyber threats, are universal. Veritis deployed encryption protocols, real time threat monitoring, access controls, and secure application practices to build a robust defense. This case study serves as a testament to the adaptability of cross industry cybersecurity strategies, which can be effectively applied to secure digital transactions and ensure data privacy in high risk environments.

Read the Complete case study: Building a Resilient Cybersecurity Framework in the Digital Services Sector.

Conclusion

Secure online banking demands a proactive and comprehensive approach to addressing the industry’s unique cybersecurity challenges. By implementing robust security measures, adhering to regulatory requirements, and fostering a culture of cybersecurity awareness, banks can effectively protect their customers’ assets and maintain trust in an increasingly digital world. As technology evolves, banks must stay one step ahead of cyber threats by continually updating and enhancing their cybersecurity strategies.

Veritis, a recipient of prestigious awards such as the Stevie and Globee Business Awards, offers cutting edge solutions to bolster cybersecurity solutions in banking IT. Leveraging its strong reputation, Veritis offers advanced services and insights that empower banks to fortify their systems against cyber threats and safeguard online transactions. By partnering with industry leaders like Veritis, banks can enhance their cybersecurity posture and mitigate risks in an ever changing digital field.

Looking for Support? Schedule A Call

Also Read:

- Impact of Information Technology on the Financial Industry

- DevOps Adoption in Financial Services Industry

- The Future of IT Financial Management: Trends and Innovations

- AI and Cybersecurity: Defending Against Evolving Threats

- AIOps Use Cases: How Artificial Intelligence is Reshaping IT Management

- Overcoming Challenges: Implementing Generative AI in Healthcare