Cloud computing is transforming data storage and processing, gaining significant traction and becoming increasingly indispensable across various industries. Notably, the finance sector is experiencing the profound impact of cloud technology. Presently, over 44% of financial services firms store their data in the cloud, and this figure is expected to surpass the halfway mark, reaching 52% within the following year. But what are the driving forces behind this trend?

The finance industry has traditionally faced challenges related to financial data security, legacy systems, and scalability. However, cloud technology has emerged as a solution, offering robust security measures, facilitating modernization, and enabling unparalleled scalability.

As cloud computing continues to evolve, it enhances flexibility and scalability within the financial sector. Recent research from Google Cloud indicates that 83% of businesses now rely on cloud infrastructure.

This blog delves into the benefits of implementing cloud financial services. From cloud cost optimization to leveraging financial management software, we delve into the essentials before exploring the tangible financial advantages. Let’s explore how cloud financial services can revolutionize your sector.

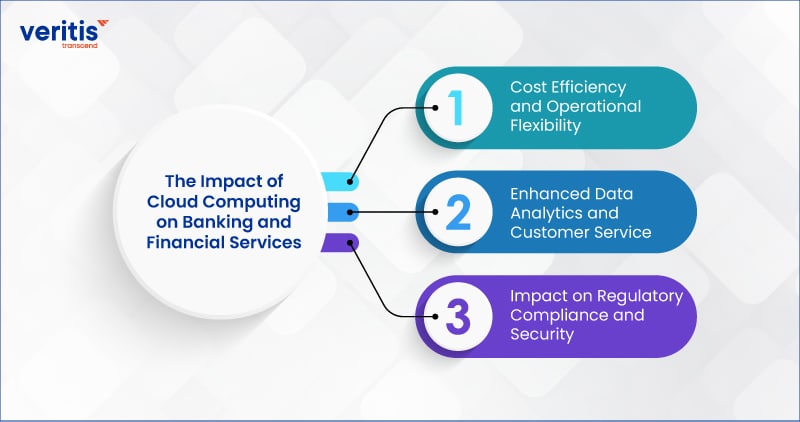

The Impact of Cloud Computing on Banking and Financial Services

The banking industry is increasingly embracing cloud computing, which has demonstrated its ability to reduce costs, expand storage capabilities, and facilitate remote work. Cloud-powered AI delivers real-time financial market analytics and enhances customer service through chatbots.

Cloud computing also influences compliance standards in financial regulation, with regulatory bodies emphasizing security. Proper implementation enhances operational security, as cloud budgeting software services specialize in cybersecurity. Financial institutions understand the significance of cloud computing in securing customer and investor funds despite changes in compliance requirements.

1) Cost Efficiency and Operational Flexibility

The banking industry increasingly leverages cloud financial services, showcasing its effectiveness in cost reduction, scalability, and enabling remote work. Cloud technologies empower financial institutions to expand storage capacities while minimizing operational expenses. Additionally, they provide the flexibility required for remote work arrangements, ensuring seamless operations regardless of location.

2) Enhanced Data Analytics and Customer Service

Cloud-powered AI is transforming financial services by providing real-time analytics on market trends and enabling customer care bots to deliver personalized assistance. Through cloud financial services, financial institutions gain access to cutting-edge analytics tools that offer valuable insights into market dynamics. Furthermore, AI-driven customer service bots enhance the customer experience by providing timely and relevant information, ultimately improving satisfaction and retention rates.

3) Impact on Regulatory Compliance and Security

Cloud computing has implications for compliance standards in financial services regulation, with regulatory bodies prioritizing protecting customers and investors against security threats. While adopting cloud technology introduces changes to compliance requirements, it also presents opportunities to enhance security measures. Cloud service providers specialize in security protocols, mitigating risks associated with cyber threats and malicious attacks. Financial institutions recognize the importance of Cloud Financial Services in bolstering the security of financial operations, thus prioritizing its integration into their IT infrastructure to safeguard customer and investor funds.

Useful Link: How Does Cloud Computing Help Fintech?

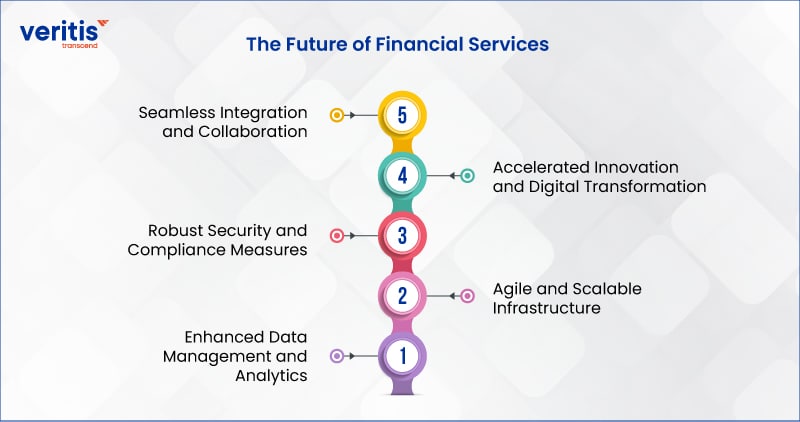

The Future of Financial Services

Cloud computing is reshaping the financial services industry, offering opportunities for innovation and efficiency. This explores the technical aspects of cloud computing in finance, focusing on data management, scalability, security, innovation, and collaboration. Understanding these elements is crucial for navigating the future of financial services.

1) Enhanced Data Management and Analytics

Cloud computing offers financial services unparalleled capabilities in managing and analyzing vast data. With cloud-based accounting solutions, financial institutions can leverage advanced analytics tools to increase valuable insights into customer behavior, market trends, and risk management strategies. Firms can streamline operations and make more informed business finance solutions decisions by centralizing data storage and processing on cloud expense management platforms.

2) Agile and Scalable Infrastructure

The flexibility and scalability of cloud expense management allow financial institutions to adjust to evolving market conditions and effectively meet customer demands. The cloud-based accounting infrastructure allows for rapidly deploying new services and applications, enabling organizations to respond to market opportunities and regulatory requirements quickly. Moreover, cloud scalability ensures that financial services can efficiently handle fluctuations in transaction volumes and scale resources up or down as needed, optimizing performance and cost-effectiveness.

3) Robust Security and Compliance Measures

Security and compliance are paramount concerns for the financial services industry, and cloud computing offers robust solutions to address these challenges. Cloud service providers invest in state-of-the-art security technologies and adhere to strict compliance standards, such as GDPR and PCI DSS. By leveraging the security expertise of cloud providers, financial institutions can enhance data protection, mitigate cybersecurity risks, and ensure compliance with regulatory requirements.

4) Accelerated Innovation and Digital Transformation

Cloud computing accelerates innovation and drives digital finance transformation within the financial services sector. By migrating to cloud-based environments, organizations can modernize legacy systems, streamline workflows, and introduce innovative services such as mobile banking, robo-advisors, and blockchain-based business finance solutions. Cloud expense management platforms provide the foundation for fintech collaboration and experimentation, nurturing an environment of innovation and creating novel products and services.

5) Seamless Integration and Collaboration

Cloud computing enables seamless integration and collaboration across the financial services ecosystem. Organizations can securely share data and services with partners, fintech startups, and third-party developers by leveraging APIs and cloud-based platforms. This ecosystem approach fosters collaboration, accelerates innovation, and enhances the customer experience by providing seamless access to various financial services and products. Additionally, cloud-based collaboration tools facilitate remote work and enable geographically dispersed teams to collaborate effectively in real time.

Useful Link: DevOps Adoption in Financial Services Industry

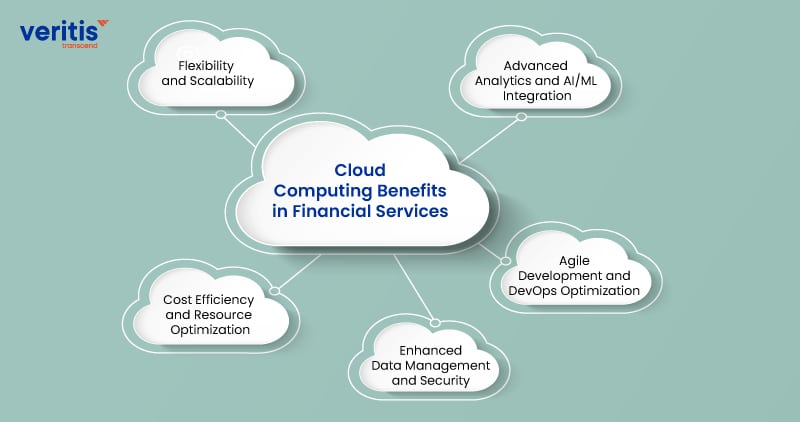

Cloud Computing Benefits in Financial Services

Cloud computing is reshaping the financial services sector, offering many technical advantages. This explores how cloud technology is revolutionizing data management, scalability, financial data security, development practices, and advanced analytics in finance. By examining these areas, we delve into the transformative impact of cloud computing on the technical domain of financial services, driving innovation and efficiency.

1) Flexibility and Scalability

Cloud technology offers unparalleled flexibility and scalability, overcoming traditional infrastructure limitations. In financial services, cloud computing enables rapid access to data for regulatory reporting, risk analysis, and deep learning applications. With cloud architecture, financial institutions can dynamically scale resources to accommodate, ensuring optimal performance, fluctuating workloads, and responsiveness.

2) Cost Efficiency and Resource Optimization

Migrating to the cloud eliminates the need for costly upkeep of legacy systems and allows organizations to pay only for the resources they consume. The pay-as-you-go cloud computing model optimizes operational costs by capably allocating computing resources based on demand. This reduces expenses and maximizes the utilization of financial resources, driving overall efficiency and competitiveness.

3) Enhanced Data Management and Security

Cloud-based solutions facilitate effective data management by providing centralized storage and seamless integration of disparate data sources. Financial institutions can leverage cloud platforms to break down data silos and establish cohesive data structures, enabling better decision-making and risk management. Cloud financial data security measures, including encryption, access controls, and threat detection systems, bolster data protection and compliance adherence, mitigating cybersecurity risks and ensuring regulatory compliance.

4) Agile Development and DevOps Optimization

Cloud integration enables fintech firms to accelerate software development and deployment cycles through streamlined DevOps practices. Organizations can automate infrastructure provisioning, testing, and deployment processes by leveraging cloud-based tools and platforms, reducing time-to-market for new products and services. Furthermore, cloud environments facilitate continuous monitoring and optimization of applications, ensuring compliance with regulatory standards and enhancing operational resilience.

5) Advanced Analytics and AI/ML Integration

Cloud computing unlocks new possibilities for advanced analytics and machine learning integration in financial services. With access to scalable computing resources and specialized AI/ML services, banks and fintech startups can leverage predictive analytics, anomaly detection, and personalized recommendation systems to improve customer experiences and mitigate risks. Cloud-based AI/ML solutions enable real-time analysis of large volumes of financial data, empowering organizations to uncover valuable insights and drive innovation in product development and customer engagement strategies.

Adopting cloud computing in financial services offers numerous technical benefits, including flexibility, cost efficiency, enhanced data management, agile development, and advanced analytics capabilities. Leveraging cloud technology capabilities empowers financial institutions to distinguish themselves in today’s dynamic market environment, offering pioneering cloud ERP solutions and unparalleled customer experiences.

Conclusion

Veritis stands as a beacon of innovation and excellence in banking and financial services. With a track record adorned with prestigious accolades like the Stevie and Globee Business Awards, Veritis continues to lead the charge in providing advanced cloud solutions tailored to the evolving needs of Financial Services Institutions (FSIs) worldwide.

As FSIs increasingly embrace Veritis’ private, public, and hybrid cloud offerings, they are not just adapting to change but actively driving innovation and reshaping their operations for a future characterized by dynamic shifts and technological advancements. With Veritis’ transformative cloud solutions, FSIs are poised to thrive in the ever-changing banking field, ensuring their relevance and success in the years to come.

Looking for Support? Schedule A Call

Also Read: