Financial leaders are under pressure to move faster, tighten controls, and deliver cleaner insights. This is why digital transformation in finance and accounting has become a board level priority. The conversation is about accuracy, speed, and the ability to steer the business with real data.

Global benchmarks already show the shift. Companies that modernize their finance function report 25 to 30% lower operating costs, 40 to 60% faster month end cycles, and 20 to 40% improvement in forecast accuracy (McKinsey, PwC). These gains explain why investments in digital transformation in finance industry and digital transformation in accounting continue to accelerate, even in constrained budgets.

For CFOs and CIOs, the goal is straightforward: use digital finance transformation to replace manual work with automated, connected, real time processes. This also changes the accountant’s role. Organizations pursuing digital transformation for accountants are automating routine tasks and redirecting teams toward analysis and scenario planning. That shift is only possible because digitalization in finance reduces reconciliation work, error rates, and reporting delays.

The leaders who capture the most value follow a structured finance digital transformation roadmap. Many now rely on specialized digital transformation services to accelerate results without disrupting core operations. The banking sector sets the pace. Institutions ahead in digital transformation in banking industry are outperforming peers on cost ratios, compliance readiness, and customer trust.

Talk to a Digital Transformation Expert

What is Digital Transformation in Finance and Accounting?

Digital transformation in finance and accounting begins with rethinking how the finance function operates at an enterprise level. In leading organizations, the finance team is not about a reporting engine. It is a real time intelligence system that guides digital transformation strategy, performance, and risk. This shift is powered by digital transformation in finance and accounting, where automation, analytics, and integrated data replace slow, manual, error prone processes.

A) The New Finance Operating Model

Modern finance teams use automated workflows, connected systems, and intelligent dashboards to give leaders real time clarity on cash flow, profitability, and enterprise risk. This shift is why digital transformation in finance industry continues to accelerate. Cloud platforms, predictive analytics, and AI can be placed at the center of digital finance transformation, enabling faster forecasting, tighter controls, and higher confidence decisions without waiting for month end cycles.

B) Accounting Moves to Intelligent Automation

As finance becomes real time, accounting advances with it. Digital transformation in accounting replaces manual, spreadsheet heavy work with automated processes that handle reconciliations, journal entries, validations, and compliance tasks. This shift enables digital transformation for accountants, freeing teams to focus on analysis and advisory work. With digitalization in finance, data flows seamlessly across systems, reducing errors, reconciliation time, and reporting delays.

C) Why It Matters to Executives

For leaders, this combined transformation, finance first, accounting next, delivers measurable outcomes:

- Faster closes

- Cleaner, more reliable data

- Lower operational costs

- Stronger governance

- High confidence forecasts

Enterprises that follow a structured finance digital transformation roadmap consistently achieve higher accuracy, better compliance, and more scalable financial operations. With digital transformation consulting services, organizations accelerate adoption while minimizing disruption. Highly regulated sectors, including those advancing digital transformation in banking industry, are proving how powerful this transformation can be.

Digital transformation in finance and accounting creates a financial engine that moves as fast as the business, and often ahead of it.

Useful link: Successful Digital Transformation: CEO’s Path to Digital Transformation Success

Why Financial Accounting is Moving Toward Digital Transformation?

1) Compliance and Regulation

Companies face more audits, real time reporting requirements, and stricter controls. Manual processes cannot keep up. Digital systems reduce compliance risk and create auditable, error free workflows.

2) Need for Real Time Financial Insight

Executives want live visibility into revenue, cash flow, and margins. Automation and connected data shorten close cycles by 40 to 60% and improve accuracy (McKinsey, PwC). This shift pushes accounting teams to modernize.

3) CFO Focus on Cost and Productivity

CFOs are prioritizing finance modernization. Nearly 73% list finance transformation as a top strategic priority (PwC), and 98% invested in financial automation or AI in the last year (Gartner). The pressure to reduce operating costs by 25 to 30% is driving transformation programs.

4) Talent Gaps and Changing Roles

Routine accounting work is challenging to staff and unappealing to modern professionals. Financial automation eliminates repetitive tasks, allowing accountants to focus on analysis, controls, and decision support.

5) Rising Data Volumes

Organizations generate more financial and operational data than spreadsheets can handle. AI and data analytics in digital transformation enable teams to forecast more accurately, identify anomalies more quickly, and provide leadership with real-time accounting insights.

6) Mature Cloud and Automation Tools

Cloud platforms and automation technologies are now proven and secure. As the banking sector has demonstrated, digital systems reduce errors, lower processing costs, and increase operational efficiency, making modernization a low risk, high return investment.

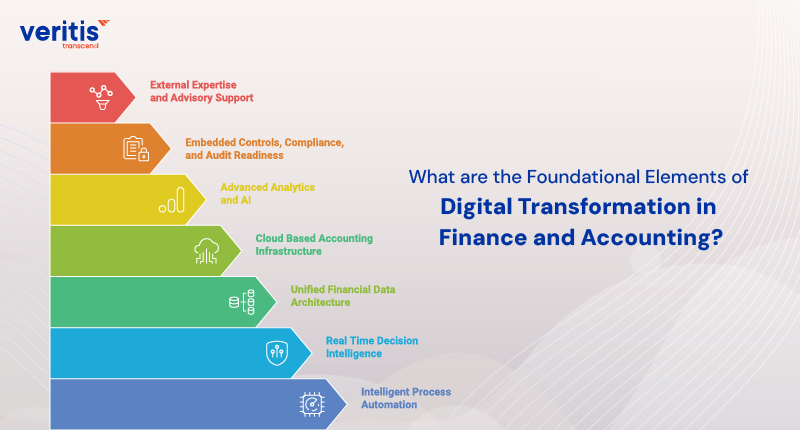

What are the Foundational Elements of Digital Transformation in Finance and Accounting?

1) Intelligent Process Automation

What is It?

Automation replaces manual journal entries, reconciliations, invoice handling, expense validation, and approval workflows. It removes friction from the core engines of digital transformation in finance and accounting.

What Does It Enable?

- Up to 40% of accounting tasks automated (McKinsey).

- Faster closes with lower error rates.

- Reduced operational cost and rework.

- More time for analysis, controls, and strategic support.

Executive Impact

- McKinsey finds that 40% of accounting tasks can be automated, exploring capacity for analysis and governance.

- This is a foundational pillar of digital transformation in accounting and finance.

2) Real Time Decision Intelligence

What is It?

Continuous close models, live dashboards, automated variance tracking, and predictive financial alerts are core capabilities of digital transformation in finance industry.

What Does It Enable?

- 30 to 60% faster reporting cycles (Accenture).

- Real time visibility into cash flow, margins, and risks.

- Faster decisions for CEOs and CFOs.

- Shift from backward looking reports to always on intelligence.

Executive Impact

Accenture reports 30 to 60% faster reporting cycles, enabling CFOs and CEOs to act on signals immediately, and driving momentum in digital transformation in finance industry.

3) Unified Financial Data Architecture

What is It?

Connecting ERP, CRM, procurement, billing, banking, and operational systems into one unified financial ecosystem is the foundation of scalable digitalization in finance.

What Does It Enable?

- A single source of truth for leadership.

- Reduced reconciliation and manual consolidation.

- Stronger governance, accuracy, and audit readiness.

- Seamless data flow across the enterprise.

Executive Impact

- Eliminates spreadsheet driven rework

- Strengthens governance and accuracy. This is the core enabler of digitalization in finance and enterprise wide reporting maturity.

4) Cloud Based Accounting Infrastructure

What is It?

Migrating finance workloads to secure, scalable cloud platforms. A core pillar of digital finance transformation for global organizations.

What Does It Enable?

- 20 to 25% lower IT spend (PwC).

- Continuous availability and built in resilience.

- Stronger security, access control, and scalability.

- Faster deployment of new capabilities and tools.

Executive Impact

- PwC notes 20 to 25% IT cost reduction for cloud enabled finance.

- This shift is at the center of digital finance transformation, especially for global operations.

5) Advanced Analytics and AI

What is It?

AI driven forecasting, anomaly detection, scenario modeling, real time alerts, and automated insights, are now central to digital transformation for accountants.

What Does It Enable?

- Finance teams deliver 2× more actionable insights (Deloitte).

- Better forecasting accuracy and risk visibility.

- Automated detection of irregularities and anomalies.

- Stronger executive decision support.

Executive Impact

- Deloitte shows analytics enabled finance teams deliver 2× strategic insights to the C-suite.

- This transforms the role of accounting, supporting digital transformation for accountants.

6) Embedded Controls, Compliance, and Audit Readiness

What is It?

Digital workflows enforce policies, audit trails, validation checks, and regulatory rules, which are critical for regulated industries and digital transformation in banking industry.

What Does It Enable?

- Real time compliance monitoring.

- Lower audit preparation time and cost.

- Reduced risk exposure from manual errors.

- Predictable, transparent, and controlled processes.

Executive Impact

- Reduces compliance cost and audit preparation time

- Supports programs aligned with a finance digital transformation roadmap.

- This is especially important in regulated environments like digital transformation in banking industry.

7) External Expertise and Advisory Support

What is It?

Leveraging digital transformation services and digital transformation consulting services to accelerate transformation, reduce risk, and maximize ROI.

What Does It Enable?

- Faster implementation with fewer disruptions.

- Proven roadmaps instead of trial and error.

- Higher ROI and adoption success.

- Guidance across the full finance digital transformation roadmap.

Executive Impact

High performing enterprises leverage digital transformation services and consulting to accelerate timelines, ensure ROI, and mitigate project risk.

Useful link: Top 10 Digital Transformation Trends for 2025 and Further

Key Technology Trends Driving Digital Transformation in Finance and Accounting

1) The Rise of Autonomous Finance Systems

Modern accounting platforms are increasingly operating with minimal human intervention. AI engines classify transactions, predict coding errors, handle reconciliations, and resolve routine exceptions before teams even notice them.

Executive Insight

Leading firms adopting autonomous finance report:

- Up to 40% fewer manual tasks (McKinsey)

- Higher accuracy in transaction processing

- Faster month end without adding headcount

Why Does It Matter?

Accounting shifts from “processing work” to “supervising and validating intelligent systems.”

2) Real Time Financial Infrastructure

Organizations are moving away from the concept of a period end close. Data flows continuously from ERP, CRM, banking, procurement, and revenue systems into a unified financial core.

Executive Insight

Accenture notes that continuous close models deliver:

- 30 to 60% faster cycles

- Immediate visibility into revenue, margin, and liquidity

Why Does It Matter?

Executives make decisions with the same data accuracy they expect from trading floors, not legacy month end reports.

3) Cloud First Accounting Architecture

Finance functions are migrating away from on-premises environments toward cloud native platforms.

Executive Insight

Cloud enabled finance organizations’ experience:

- 20 to 25% lower IT overhead (PwC)

- Stronger cybersecurity and access control

- Faster rollout of automation and analytics

Why Does It Matter?

Finance gains scalability, resilience, and global access without the friction of infrastructure.

4) Predictive and Prescriptive Analytics

Forecasting does not depend solely on human models. AI evaluates trends, market factors, seasonality, customer behavior, and micro level transaction anomalies.

Executive Insight

Deloitte reports that analytics driven finance teams deliver:

- 2× more strategic insights to CEOs and boards

Why Does It Matter?

Predictive insights let leaders act before financial outcomes shift, not after.

5) Intelligent Document Ecosystems

Instead of manually keying in invoice or contract data, accounting teams rely on machine learning to extract, categorize, and validate documents.

Executive Insight

AI driven document processing reduces:

- Turnaround time for AP/AR

- Exceptions caused by human error

- Compliance risk

Why Does It Matter?

High volume workflows scale without adding people.

6) Secure Ledger Technologies and Auditability

Blockchain and distributed ledgers introduce immutable transaction records, strengthening trust in financial data.

Executive Insight

Enterprises experimenting with blockchain in accounting reports:

- Reduced reconciliation effort

- Cleaner intercompany transaction trails

- Faster external audits

Why Does It Matter?

Audit integrity becomes a built in feature, not a year end exercise.

7) Embedded Security and Governance in Finance Platforms

Cybersecurity in banking has become a finance leadership issue. Modern finance systems come with encryption, identity governance, and automated controls.

Executive Insight

Finance teams prioritize security because:

- Financial data is a top cyber target

- Regulatory scrutiny continues to rise

- Manual access control creates risk exposure

Why Does It Matter?

Secure accounting environments protect revenue, reputation, and compliance.

8) High Connectivity Finance Ecosystems

APIs now link ERP, CRM, treasury, procurement, tax engines, banking networks, and analytics platforms into a consolidated financial engine.

Executive Insight

Connected finance ecosystems explore:

- Real time data flow between business units

- Unified reporting

- Reduced reconciliation and manual consolidation

Why Does It Matter?

Executives finally get accurate, enterprise wide financial intelligence.

9) Workforce Evolution Toward Digital Accountants

Technology is reshaping the talent model. Accountants now focus on interpretation, scenario planning, stakeholder engagement, and risk analytics.

Executive Insight

Surveys show:

- 67% of accounting professionals expect AI dominance in 5 years

- Most leaders cite difficulty hiring for traditional accounting roles

Why Does It Matter?

Digital transformation improves accounting into a strategic advisory function.

Useful link: How Digital Transformation Maturity Models Help Organizations Scale Their Digital Efforts

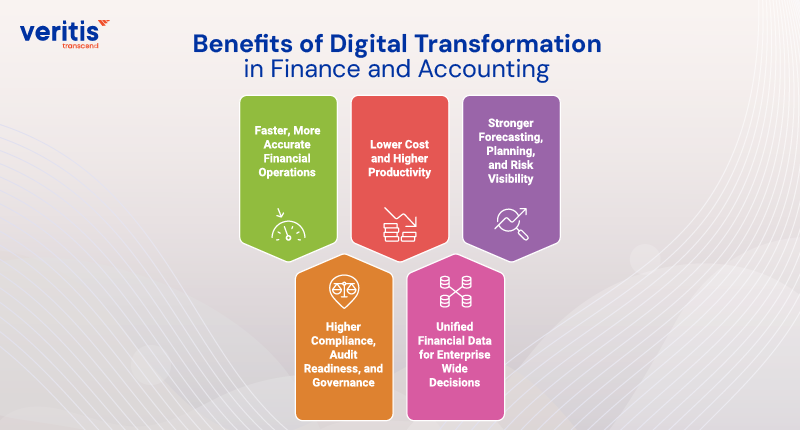

Benefits of Digital Transformation in Finance and Accounting

1) Faster, More Accurate Financial Operations

Leadership Insight

Modernizing the finance function eliminates delays and manual rework. With digital transformation in finance and accounting, teams gain real time accuracy, tighter controls, and faster processing.

What Does This Deliver?

- Shorter close and reporting cycles

- Reduced exceptions and errors

- Real time intelligence for CEOs, CFOs, CIOs, and COOs

- Consistent financial clarity across the organization

2) Lower Cost and Higher Productivity

Leadership Insight

Automation is redefining efficiency across the enterprise. Through digital transformation in finance industry and digital transformation in accounting, organizations streamline workflows and reduce operational overhead without compromising governance.

What Does This Deliver?

- Less manual workload and processing cost

- Increased capacity without increasing headcount

- Productivity gains across finance and accounting teams

- Clear ROI through automation and integrated systems

3) Stronger Forecasting, Planning, and Risk Visibility

Leadership Insight

Executives want reliable forecasts, early warnings, and forward looking intelligence. With digital finance transformation, financial planning models become more predictive, data driven, and responsive to market shifts.

What Does This Deliver?

- Better forecasting accuracy

- Automated risk alerts and anomaly detection

- More informed strategic planning

- High confidence insights for decision making

4) Higher Compliance, Audit Readiness, and Governance

Leadership Insight

Regulatory requirements are more demanding than ever. By advancing digital transformation for accountants and digitalization in finance, and conducting a digital transformation audit, companies embed compliance into everyday workflows rather than treating it as a manual year end burden.

What Does This Deliver?

- Automated controls and policy enforcement

- Continuous audit trails

- Reduced compliance risk

- Faster, cleaner audits

5) Unified Financial Data for Enterprise Wide Decisions

Leadership Insight

Disconnected systems limit executive visibility. A structured finance digital transformation roadmap, supported by digital transformation services and consulting, creates a unified financial ecosystem that enhances accuracy and trust.

What Does This Deliver?

- Single source of truth across business units

- Integrated ERP, CRM, procurement, and banking data

- Faster insights for leadership

- Stronger financial alignment across the enterprise, critical in fast moving environments such as digital transformation in banking industry

Useful link: How Is Digital Transformation in Healthcare Driving Innovation for C-Suite Executives?

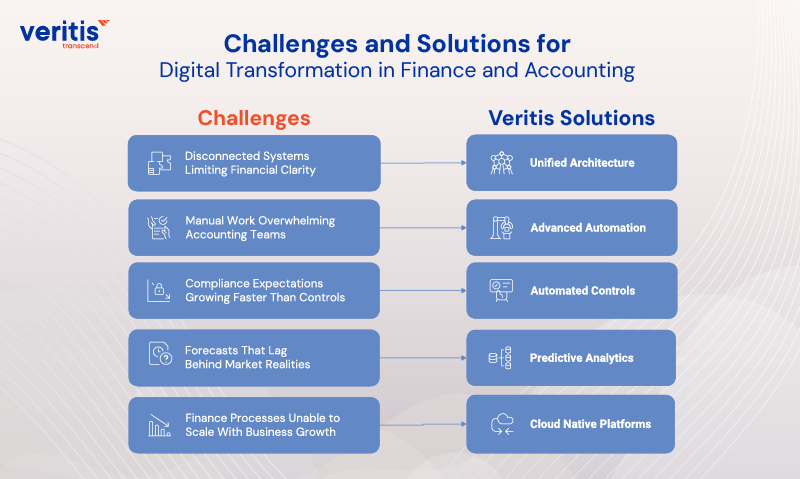

Challenges and Solutions for Digital Transformation in Finance and Accounting

1) Disconnected Systems Limiting Financial Clarity

Most enterprises still operate with siloed data across ERP, CRM, procurement, and banking tools. This slows insight generation and weakens accuracy, one of the core barriers to digital transformation in finance and accounting.

Veritis Solution

Veritis connects your entire financial ecosystem into one unified architecture. Through enterprise integration, intelligent workflows, and real time data pipelines, we eliminate fragmentation and support large scale digitalization in finance, giving executives a single, trusted view of performance.

2) Manual Work Overwhelming Accounting Teams

Reconciliations, journal entries, invoice matching, and exception handling consume hours that should be spent on strategic work. This is a major blocker for organizations pursuing digital transformation in accounting and more efficient finance operations.

Veritis Solution

Veritis deploys advanced automation, AI workflows, and continuous close frameworks to accelerate digital transformation for accountants. We help teams move from manual tasks to strategic analysis while improving speed, accuracy, and operational efficiency.

3) Compliance Expectations Growing Faster Than Controls

Regulators demand faster reporting, real time audit trails, and stronger governance. Many enterprises lack the maturity required for modern compliance, especially those moving toward global digital transformation in finance industry.

Veritis Solution

Veritis strengthens governance with automated controls, digital audit logs, and built in policy enforcement. We align your compliance model with best practices used in high regulation sectors, including digital transformation in banking industry, reducing risk and audit friction.

4) Forecasts That Lag Behind Market Realities

Static spreadsheets and outdated modeling approaches delay executive decisions. Without predictive capabilities, organizations cannot fully realize the value of digital finance transformation or anticipate risks early.

Veritis Solution

Veritis implements predictive analytics, AI forecasting, and scenario simulation tools. We build a forward looking planning engine aligned with your finance digital transformation roadmap, providing leadership with earlier insights, greater accuracy, and stronger confidence in decision making.

5) Finance Processes Unable to Scale With Business Growth

As companies expand across markets, products, or geographies, traditional finance processes break down. Growth demands scalable systems, not manual workarounds, especially for enterprises investing in digital transformation services and digital transformation consulting services.

Veritis Solution

Veritis modernizes finance operations with cloud native platforms, scalable architectures, and global expansion frameworks. We ensure your finance organization grows smoothly, supports enterprise complexity, and sustains high performance as transformation accelerates.

Case Study: Revolutionizing Financial Services Through Digital Transformation

A leading financial services provider collaborated with Veritis to modernize its operations and accelerate its digital transformation journey.

Challenge:

The organization faced slow, manual processes, fragmented customer experiences, and outdated security measures that limited scalability and responsiveness.

Solution:

Veritis delivered a comprehensive digital transformation roadmap, implementing digital transformation through process automation, real time analytics, enhanced cybersecurity, and agile delivery practices to streamline operations and elevate customer engagement.

Results:

- Automated workflows, improved operational efficiency, and reduced manual effort

- Personalization and unified user experiences strengthened customer satisfaction

- Advanced security capabilities increased system resilience

- Agile practices accelerated release cycles and improved project alignment

This case demonstrates how modern digital tools and a well-structured transformation strategy can help financial organizations enhance performance, security, and customer trust.

Read the Full Case Study: Revolutionizing Financial Services Through Digital Transformation

Conclusion

Digital transformation in finance and accounting is now a leadership priority. Executives want faster cycles, cleaner data, and real time control, and that’s what modern finance delivers.

Veritis helps enterprises achieve this. Through our work across digital transformation in finance industry, digital transformation in accounting, and end to end digital finance transformation, we enable finance teams to automate, integrate, and operate at enterprise speed. We support digital transformation for accountants, guide digitalization in finance, and build a clear finance digital transformation roadmap backed by proven digital transformation consulting services.

For highly regulated sectors, including organizations advancing digital transformation in banking industry, Veritis strengthens compliance, insight, and scalability.