In the current market scenario, fast and frequent value delivery is imperative for businesses to gain an edge. And banking and financial institutes could be more exceptional. The banking, financial services, and insurance (BFSI) sector is hard-pressed to meet customers’ ever-changing demands and expectations without compromising on quality and speed of delivery.

According to RedGate, over 80% of financial services firms have embraced various banking and DevOps practices, marking a widespread adoption within the industry. This shift towards DevOps indicates the sector’s recognition of the benefits of streamlined development and operational processes.

In alignment with this trend, the global DevOps in financial services market is projected to experience substantial growth, with an anticipated valuation of USD 25.5 billion by 2028 and an impressive compound annual growth rate (CAGR) of 18.95%, as reported by Radixweb. These statistics underscore the increasing significance of DevOps methodologies in optimizing efficiency, enhancing collaboration, and ultimately contributing to the overall success of financial institutions worldwide.

As an industry involving time critical financial operations, BFIS firms naturally demand uninterrupted customer service and robust internal infrastructure for seamless operations. This eventually resulted in a demand for technology integration. And, one technology solution that appeared as an immediate answer for seamless and faster delivery of services is DevOps, a technology recognized more as a DevOps culture in finance.

Useful Link: 3 Factors That Decide Organizational Readiness to DevOps Adoption

DevOps As A Way Forward

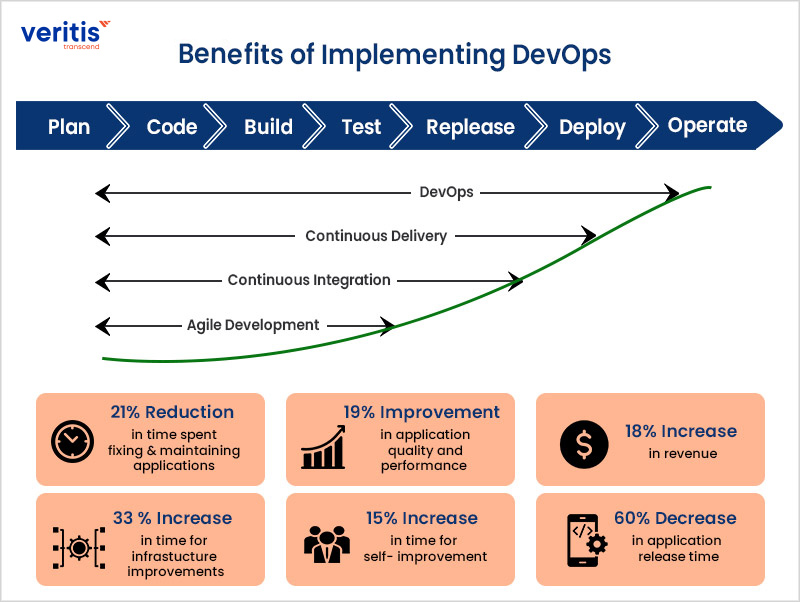

DevOps emerged as a boon to fast-growing industries like financial services because of its attributes like CD, enhanced security, quick quality delivery, increased collaboration, and a new working DevOps culture in finance.

Let’s take a closer look at some of the essential banking and DevOps practices that can transform the way the financial services industry operates:

Process Automation – This is the crucial aspect of DevOps that can substantially benefit financial sector IT modernization industry in quickening internal processes. Automation of tasks across the process chain or software delivery cycle comes as an effective means to achieve efficient resource utilization, improved product quality and enhanced developer productivity while balancing responsibilities across the cross-project requirements, frequent updates and overall process management at the enterprise level. In fact, this leads to continuous delivery and eventually lessens the time for market release while ensuring scalability and compliance with standards.

Process Automation – This is the crucial aspect of DevOps that can substantially benefit financial sector IT modernization industry in quickening internal processes. Automation of tasks across the process chain or software delivery cycle comes as an effective means to achieve efficient resource utilization, improved product quality and enhanced developer productivity while balancing responsibilities across the cross-project requirements, frequent updates and overall process management at the enterprise level. In fact, this leads to continuous delivery and eventually lessens the time for market release while ensuring scalability and compliance with standards. Security – This is the very fundamental factor that stopped or concerned firms in the financial sector IT industry while on their move for digital transformation. Though the quick delivery process of DevOps was initially considered as a means to compromise security, many financial services on the way forward reported security enhancement and faster recovery through banking and DevOps practices. DevSecOps came as an additional advantage ensuring a full-fledged security integration across the pipeline. Resultant, many firms in the industry started looking at DevOps tools for finance as a resource to address security.

Security – This is the very fundamental factor that stopped or concerned firms in the financial sector IT industry while on their move for digital transformation. Though the quick delivery process of DevOps was initially considered as a means to compromise security, many financial services on the way forward reported security enhancement and faster recovery through banking and DevOps practices. DevSecOps came as an additional advantage ensuring a full-fledged security integration across the pipeline. Resultant, many firms in the industry started looking at DevOps tools for finance as a resource to address security. Internal Functioning or Culture –More than technology, DevOps is appreciated for the cultural setup it brings to an organization. That aspect forms DevOps as a combination of Development (Dev) and operations (Ops). DevOps practices bring different teams together into a single platform while connecting all of them to a project pipeline. This can be of prime importance for DevOps in financial services firms on their move to the digital race as DevOps culture in Finance facilitates the functioning of development, operations, and Quality Assurance (QA) while promoting effective collaboration and knowledge-sharing, bringing ease in internal functioning.

Internal Functioning or Culture –More than technology, DevOps is appreciated for the cultural setup it brings to an organization. That aspect forms DevOps as a combination of Development (Dev) and operations (Ops). DevOps practices bring different teams together into a single platform while connecting all of them to a project pipeline. This can be of prime importance for DevOps in financial services firms on their move to the digital race as DevOps culture in Finance facilitates the functioning of development, operations, and Quality Assurance (QA) while promoting effective collaboration and knowledge-sharing, bringing ease in internal functioning. Management –Large organizations often face issues because of widely distributed internal teams, which might lead to miscommunication, distracting the process flow when required. DevOps tools for finance effectively handle all the software delivery pipeline stages (release, deploy, test, and build), ensuring shared visibility and process control among teams. This includes avoiding discrepancies among teams and breaking down functional silos by effectively dealing with every aspect of the software delivery pipeline. This is accomplished by integrating advanced IT processes across all levels of the organization to ensure smooth process flow to production.

Management –Large organizations often face issues because of widely distributed internal teams, which might lead to miscommunication, distracting the process flow when required. DevOps tools for finance effectively handle all the software delivery pipeline stages (release, deploy, test, and build), ensuring shared visibility and process control among teams. This includes avoiding discrepancies among teams and breaking down functional silos by effectively dealing with every aspect of the software delivery pipeline. This is accomplished by integrating advanced IT processes across all levels of the organization to ensure smooth process flow to production.

Benefits of Deploying DevOps in Fintech

1) Swift Delivery Enabled by DevOps in the Fintech Sector

Adopting fintech DevOps Strategies sector ensures swift and efficient delivery processes. Companies that have integrated DevOps practices demonstrate a greater propensity for constant evolution, improvement, and regular updates than those that have not embraced these methodologies.

By promoting DevOps practices such as a delivery pipeline, the coding process can unlock many functionalities and capabilities while instilling a high level of discipline. Implementing these practices facilitates seamless access to services like GitHub and BitBucket, including features such as multi-branch support, pull request detection, and organization scanning. In essence, DevOps accelerates the overall software development and delivery lifecycle.

2) Enhanced Security Practices in Fintech Through DevOps Implementation

Security is pivotal for any organization, particularly those handling financial transactions. Given the nature of financial services involving funds, money transfers, and more, it becomes imperative to safeguard associated data. This necessitates the adoption of top-notch software applications that adhere to the highest cloud security standards and guidelines. Within this context, incorporating Development Security Operations, commonly known as DevOps for security compliance in software, emerges as an essential discipline when leveraging DevOps methodologies.

3) Minimal Downtime Assurance Through DevOps in the Fintech Sector

Due to infrastructure failures, enterprises may lose significant money within an hour. The costs associated with unexpected disruptions are notably substantial in the financial services sector. In this highly competitive industry, managing infrastructural breakdowns is only possible for some companies, especially those in financial services. Adopting DevOps tools for finance is a viable solution to mitigate downtime.

Leveraging fintech DevOps Strategies, enabling an organization to utilize a set of distinct and customizable services and necessitating a microservices architecture for development, empowers businesses to deploy with minimal downtime. This approach proves instrumental in addressing implementation challenges and minimizing maintenance issues effectively.

4) Cloud Support and Availability Enhanced by DevOps in the Fintech Sector

The decentralization of DevOps in banking services is underway with the prevalence of gadgets. Individuals have grown accustomed to continuous access to financial services, commodities, and guidance, all facilitated by the mobile apps developed by the fintech industry. To provide comprehensive assistance and programs through your fintech application, there’s no need to engage support staff or establish an extensive infrastructure; instead, leveraging cloud services ensures reliable around-the-clock support.

Cloud-based Software as a Service (SaaS) platforms not only maintain app availability but also incorporate auto-scaling functionality, adept at handling fluctuations in demand corresponding to the evolving consumption habits of customers.

Financial Industry DevOps Trends

Owing to ease in adaptability and efficiency, DevOps practices have drawn more extensive attention across industries.

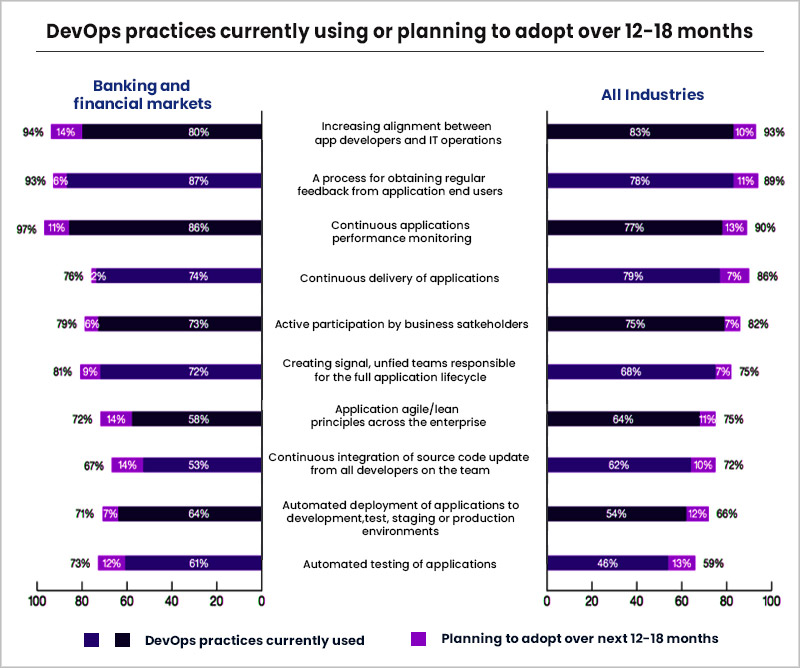

Recent statistics that compared DevOps adoption across all industries (as a whole referred to as ‘other industries’) with the financial services industry (devops in banking and financial markets) found the latter standing atop with 93 percent adoption just a single percentage above the previous standing at 92 percent.

While 80 percent of the firms in the financial services sector are already implementing DevOps practices, 14 percent are trying to do so in the coming 12-18 months period contributing to an overall rate of 94 percent.

Whereas in the case of other industries, the rate is high for the current state of DevOps adoption in banking

83 percent of firms in other industries currently have DevOps, and 10 percent are looking to do so during the period above, totaling the overall DevOps adoption in banking rate of 93 percent; however, it is 1% below the DevOps in banking and financial markets of the financial services sector.

Some of the DevOps practices that are on-demand across industries either already on or under plans for implementation during the said period include:

- Increasing alignment between app developers and operations teams

- A process for receiving regular feedbacks from end-users

- Continuous application performance monitoring

- Active participation of business stakeholders

- Creating single and unified teams for the full development lifecycle

- Applying Agile DevOps in financial institutions principles across the enterprise

- Continuous integration of source code from developers team

- Automated deployment of applications across development, test, staging and production stages

- Automated testing of applications

The aspects mentioned above are high on demand across industries, especially the devops in banking and financial services industry, directly driving the adoption of DevOps practices.

Useful Link: Accelerating DevOps Adoption in the Federal Sector!

Challenges Hampering DevOps Adoption in Financial Sector

Of course, DevOps adoption in banking is easier said than done. The reality is that DevOps implementation in the financial services IT transformation industry is complex, and several barriers exist that can slow or even halt it. High dependency on legacy systems, lack of tech literacy and relevant skills are some of the biggest obstacles to technology adoption in FSI.

Using legacy systems is creating concerns pertaining to regulatory compliance and security concerns for most organizations, lessening the chances of in-house innovation and new deployments.

To be in line with the new trend and enhance the speed at which they operate, financial services IT transformation companies are looking forward to upgradation of their existing infrastructure, both front-end and back-end infrastructure, by adopting modernized and advanced technology solutions.

These challenges combined mandates a holistic, strategic approach to DevOps adoption that enables firms to remain competitive while navigating change. This is where Veritis comes in.

As a leading DevOps services provider, Veritis can help you navigate the challenges and realize the full potential of DevOps methodologies. Combining unmatched experience and specialized skills, our DevOps experts helps you in re-imaging your business models and re-inventing the ways of working to meet rapidly shifting customer and market demands.

Key Takeaways

- The financial services (FS) industry has always been an early adopter of new technology.

- Today, FS firms are leveraging DevOps methodologies to reshape and transform the industry.

- However, to capitalize on the full potential of DevOps, FS firms need to embrace it in the right way.

- Veritis can help you adopt the right DevOps approach and harness its full power for fast and frequent value delivery.

Useful Link: #10 Priorities Around Container Adoption in DevOps Lifecycle

Conclusion

Initially met with skepticism, DevOps has subsequently witnessed widespread adoption in the financial services IT transformation industry, ultimately proving immensely beneficial on a large scale. In summary, the scaling of IT processes across the enterprise, the integration of security throughout the delivery pipeline, the dismantling of functional silos, the decomposition of larger tasks into individual components distributed among collaborative teams, and the emphasis on a cohesive, collaborative approach have collectively contributed to the success of DevOps adoption.

Notably, Veritis, a recipient of prestigious awards such as the Stevie and Globee Business Awards, offers expertise in this transformative approach, further enhancing the value and impact of DevOps in financial services sector.

Got Questions? Schedule A Call

More DevOps Articles:

- Future of DevOps: Top 6 DevOps Trends in 2022 and Beyond

- Measuring DevOps Success in 4 Ways!

- 10 Ways AI is Transforming DevOps

- DevOps Implementation For Shipping/Logistic Industry

- Why Manufacturing Companies Should Be Using DevOps?

- DevOps for Retail Industry: Benefits and Strategy

- Improving Data Analysis with DevOps

- DevOps For Federal Agencies: Importance and Benefits

Process Automation – This is the crucial aspect of DevOps that can substantially benefit financial sector IT modernization industry in quickening internal processes.

Process Automation – This is the crucial aspect of DevOps that can substantially benefit financial sector IT modernization industry in quickening internal processes.  Security – This is the very fundamental factor that stopped or concerned firms in the financial sector IT industry while on their move for digital transformation. Though the quick delivery process of DevOps was initially considered as a means to compromise security, many financial services on the way forward reported security enhancement and faster recovery through banking and DevOps practices.

Security – This is the very fundamental factor that stopped or concerned firms in the financial sector IT industry while on their move for digital transformation. Though the quick delivery process of DevOps was initially considered as a means to compromise security, many financial services on the way forward reported security enhancement and faster recovery through banking and DevOps practices.  Internal Functioning or Culture –More than technology, DevOps is appreciated for the cultural setup it brings to an organization. That aspect forms DevOps as a combination of Development (Dev) and operations (Ops). DevOps practices bring different teams together into a single platform while connecting all of them to a project pipeline. This can be of prime importance for DevOps in financial services firms on their move to the digital race as DevOps culture in Finance facilitates the functioning of development, operations, and Quality Assurance (QA) while promoting effective collaboration and knowledge-sharing, bringing ease in internal functioning.

Internal Functioning or Culture –More than technology, DevOps is appreciated for the cultural setup it brings to an organization. That aspect forms DevOps as a combination of Development (Dev) and operations (Ops). DevOps practices bring different teams together into a single platform while connecting all of them to a project pipeline. This can be of prime importance for DevOps in financial services firms on their move to the digital race as DevOps culture in Finance facilitates the functioning of development, operations, and Quality Assurance (QA) while promoting effective collaboration and knowledge-sharing, bringing ease in internal functioning. Management –Large organizations often face issues because of widely distributed internal teams, which might lead to miscommunication, distracting the process flow when required. DevOps tools for finance effectively handle all the software delivery pipeline stages (release, deploy, test, and build), ensuring shared visibility and process control among teams. This includes avoiding discrepancies among teams and breaking down functional silos by effectively dealing with every aspect of the software delivery pipeline. This is accomplished by integrating advanced IT processes across all levels of the organization to ensure smooth process flow to production.

Management –Large organizations often face issues because of widely distributed internal teams, which might lead to miscommunication, distracting the process flow when required. DevOps tools for finance effectively handle all the software delivery pipeline stages (release, deploy, test, and build), ensuring shared visibility and process control among teams. This includes avoiding discrepancies among teams and breaking down functional silos by effectively dealing with every aspect of the software delivery pipeline. This is accomplished by integrating advanced IT processes across all levels of the organization to ensure smooth process flow to production.