Table of contents

Cloud computing is transforming data storage and processing, gaining significant traction and becoming indispensable across industries. Cloud Financial Services are at the forefront of this shift, helping financial institutions modernize operations, secure data, and deliver services at scale.

Currently, over 44% of financial services firms already store their data in the cloud, and this figure is projected to increase to 52% within the next year. But what are the driving forces behind this trend?

The finance industry has long faced challenges with data security, legacy infrastructure, and scalability. Cloud technology now offers a solution that enables robust security, operational flexibility, and innovation. Modern cloud platforms integrate with cybersecurity automation tools and IT security automation frameworks to enhance compliance, mitigate risks, and protect sensitive financial data.

As digital threats evolve, leading providers of cloud financial services are integrating automation, cybersecurity, and AI, as well as data security capabilities, into their platforms. This ensures real time monitoring, proactive risk detection, and the use of artificial intelligence security tools that go beyond traditional protection methods. In turn, financial institutions gain both resilience and scalability while reducing costs and downtime.

Recent research from Google Cloud highlights that 83% of businesses now rely on cloud infrastructure. For financial services, this reliance translates into improved agility, stronger customer trust, and measurable ROI, supported by AI security automation and advanced cybersecurity automation software that keep financial ecosystems secure.

Let’s explore the five key benefits of implementing cloud financial services, from cloud cost optimization strategy to operational efficiency, and demonstrate how the right approach can transform your organization’s financial future.

The Impact of Cloud Computing in Banking and Financial Services

The banking industry is rapidly embracing cloud computing as a foundation for modernization. By adopting Cloud Financial Services, institutions can reduce costs, scale storage capacity, and enable remote operations at unprecedented speed. Combined with AI, the cloud is transforming financial ecosystems, delivering real time market analytics, automated compliance, and enhanced customer engagement through intelligent chatbots.

At the same time, cloud adoption is reshaping the cybersecurity landscape. Modern cybersecurity automation tools and AI automation in cybersecurity are being embedded into financial cloud platforms, ensuring operational resilience, compliance readiness, and protection against rising digital threats.

1) Cost Efficiency and Operational Flexibility

Banks and financial institutions are increasingly leveraging cloud financial services to optimize costs, enhance scalability, and support distributed workforces. Cloud platforms minimize infrastructure expenses, while IT security automation ensures secure operations across hybrid environments. By combining automation in cybersecurity with financial cloud systems, organizations gain both operational efficiency and business continuity.

2) Enhanced Data Analytics and Customer Service

AI powered cloud solutions provide advanced analytics on financial markets, empowering executives with actionable insights. With AI automation tools in cybersecurity integrated into cloud systems, sensitive financial data is secured while analytics deliver real time intelligence. In customer service, AI security automation and chatbot frameworks streamline assistance, improve satisfaction, and reduce resolution time, demonstrating how cloud and AI together drive measurable ROI.

3) Impact on Regulatory Compliance and Security

Cloud computing influences compliance standards in the banking and financial services sector, with regulators emphasizing the need for stronger security frameworks. Leading cloud financial services providers now integrate cybersecurity automation software, automated cybersecurity protocols, and artificial intelligence security tools to align with evolving regulations.

By adopting cybersecurity automation tools, financial institutions enhance their resilience against threats such as ransomware and data breaches, while ensuring ongoing compliance.

This proactive approach, powered by AI automation and data security, not only safeguards customer and investor funds but also strengthens stakeholder trust.

The impact of Cloud Financial Services extends far beyond cost savings. By embedding cybersecurity automation, AI automation tools, and security automation frameworks into their infrastructure, banks can defend at machine speed, enhance compliance readiness, and deliver customer centric innovation.

Enterprises that adopt cybersecurity automation tools and AI driven cloud strategies today will be the ones defining the future of global finance tomorrow.

Useful Link: How Does Cloud Computing Help Fintech?

The Future of Cloud Financial Services

Cloud computing is reshaping the financial services industry by driving efficiency, innovation, and security. As banks and fintechs modernize, the cloud delivers advanced data management, scalability, cybersecurity automation, and collaboration, core pillars for future ready finance.

1) Smarter Data and Real Time Insights

Cloud platforms centralize financial data and enable advanced analytics. With cloud based accounting and expense management, institutions gain actionable insights on customer behavior, market trends, and risk exposure, supporting faster, more accurate decision making.

2) Scalable and Agile Infrastructure

The cloud provides elastic infrastructure that adapts to fluctuating transaction volumes and regulatory changes. Institutions can scale resources instantly, launch new services quickly, and optimize costs while maintaining performance across markets.

3) Next Gen Security and Compliance

Security remains paramount. Cloud providers embed cybersecurity automation, IT security automation, and automated cybersecurity frameworks to mitigate risks and enforce compliance with global standards such as GDPR and PCI DSS. By leveraging security automation tools, financial institutions gain real time threat monitoring and automated remediation.

In addition, integrating artificial intelligence security tools strengthens predictive defense, while AI automation and data security ensure sensitive financial data is continuously protected against advanced attacks.

4) Accelerating Innovation and Digital Finance

Cloud adoption drives fintech collaboration and digital transformation. From mobile banking to robo advisors and blockchain based solutions, cloud computing in fintech enables rapid experimentation and faster delivery of customer centric services through scalable and secure cloud ecosystems.

5) Connected Ecosystems and Collaboration

Through APIs and cloud platforms, banks can securely integrate with partners, startups, and third party providers. This open ecosystem fosters innovation, strengthens customer engagement, and enables real time collaboration across globally distributed teams.

The future of Cloud Financial Services lies in combining scalability, innovation, and resilience with automation in cybersecurity. Enterprises that adopt cybersecurity automation software, AI automation in cybersecurity, and AI security automation will achieve stronger compliance, lower breach risks, and future proof growth.

Useful Link: DevOps Adoption in Financial Services Industry

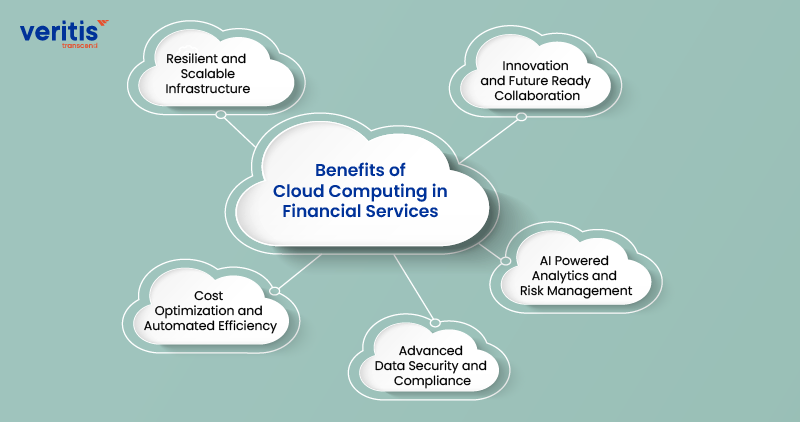

Benefits of Cloud Computing in Financial Services

Cloud computing solutions are no longer just an efficiency enabler; it has become the foundation of Cloud Financial Services in 2025. Financial institutions are leveraging the cloud for cybersecurity automation, AI driven analytics, scalability, and compliance ready resilience. By embedding AI automation in cybersecurity and automation in cyber security within cloud infrastructure, banks and fintechs can safeguard sensitive data, accelerate innovation, and deliver trusted customer experiences.

1) Resilient and Scalable Infrastructure

Cloud Financial Services offer unmatched flexibility, allowing institutions to scale resources instantly for transaction surges, regulatory reporting, or AI driven modeling. With cyber security automation tools and IT security automation, scaling doesn’t compromise protection; systems adapt dynamically while ensuring uptime and compliance.

2) Cost Optimization and Automated Efficiency

The pay as you go model reduces reliance on expensive legacy systems and optimizes resource use. By combining cybersecurity automation software with automated cybersecurity workflows, institutions can lower operational costs associated with manual monitoring, incident detection, and remediation. This approach supports IT Cost Optimization, driving measurable ROI while strengthening resilience.

3) Advanced Data Security and Compliance

Data protection remains the top priority. Cloud providers now embed cybersecurity automation tools, security automation tools, and artificial intelligence security tools to monitor environments, detect anomalies, and enforce encryption continuously. With automation in cybersecurity, organizations ensure compliance with standards like PCI DSS and GDPR while mitigating risks from cyber threats.

4) AI Powered Analytics and Risk Management

Cloud platforms integrated with AI automation and data security enable predictive analytics, fraud detection, and personalized financial services. By leveraging AI security automation and AI automation tools in cybersecurity, financial institutions can uncover patterns in massive datasets, anticipate risks, and deliver hyper personalized banking experiences.

5) Innovation and Future Ready Collaboration

Beyond efficiency, Cloud Financial Services drive fintech partnerships, open banking ecosystems, and following gen services like robo advisors and blockchain based payments. Cloud native APIs, coupled with cybersecurity automation and cybersecurity automation tools, ensure that collaboration occurs securely. This cloud computing trends accelerates innovation cycles, builds customer trust, and drives market differentiation.

The future of Cloud Financial Services is built on a foundation of scalability, innovation, and embedded cybersecurity automation. By adopting cybersecurity automation tools, AI driven automation in cybersecurity, and automated cybersecurity frameworks, financial institutions can defend at machine speed, reduce costs, and maintain continuous compliance.

For leaders, the message is clear: success in the digital financial era depends on embracing AI driven automation in cyber security and cybersecurity automation software to deliver both resilience and growth.

Case Study: Transforming Financial Operations in the Pharmaceutical Industry with Cloud Services

Veritis partnered with a leading pharmaceutical company to implement cloud computing services that optimized their financial operations, improved data accessibility, and enhanced compliance management. The client faced challenges with legacy financial systems and sought a scalable, secure cloud solution to streamline budgeting, forecasting, and reporting processes. Veritis delivered a cloud based financial platform that provided real time insights, significant cost efficiencies, and regulatory adherence, showcasing the transformative benefits of cloud financial services across complex industries and reassuring the client about the financial benefits.

Read the Complete case study: Transforming Financial Operations in the Pharmaceutical Industry with Cloud Services.

Conclusion

Veritis stands as a trusted partner for banking and financial services institutions (FSIs) navigating digital transformation. Recognized with Stevie and Globee Business Awards, Veritis delivers enterprise grade cloud financial services and cloud consulting services built on AWS, Azure, and GCP, with a focus on client satisfaction.

Through private, public, and hybrid cloud models, Veritis empowers FSIs to modernize infrastructure, enhance resilience, and embrace cybersecurity automation and AI driven cloud strategies. As the financial sector faces continuous change, Veritis ensures that institutions remain agile, compliant, and future ready positioned to lead in a rapidly evolving global marketplace.