In a fast-changing world, where everything happens at the click of a button or a tap on screen, customers are constantly seeking convenience moving providers to enhance product experience.

Technology has made its foray into almost every industry including food, health, education, science, business and among others.

And, not very far behind is our primary and most important sector, the banking sector.

Banking sector, with its fast-paced and desired quality service, caters to wider audience. In the process, it’s very important for the sector to secure its every service offering and the multiple transactions that are mostly confidential.

The dawn of digitalization proved to be crucial for enhancing the banking industry’s services but nonetheless fatal too.

Security continues to a primary concern while banking especially in this digital world!

It takes a reliable brand and a concrete security firewall to make individuals believe that their financials are safe.

While many technologies are proving to uplift banking facilities over the years, the powerful combination of DevOps and security integration, DevSecOps has turned out to be extremely helpful to this industry. Here’s how!

How DevSecops Makes Secured Banking?

Most bankers prefer predictability over agility in software delivery. However for a bank to evolve with time, it should move from separately managing independent applications, information security & operations departments and bring them together to respond to change more quickly.

It is important to note that to respond to change and maintain security at the same time, banks definitely need the DevSecOps push to be the brand that is future-ready.

As much as the DevOps collaboration and synchrony is crucial, information security also has an important part to play in creating applications for banks.

DevSecOps brings security into every step of the development process. And, with the speed at which release cycles take place reducing the software deployment to mere days, it becomes even more crucial to include and automate security into the process.

Hence, banks that are future-ready include security from the very beginning and along the process.

When we talk about banking, we no longer picture a building with designated departments, long queues, and waiting numbers.

Technology has brought banking to us as a smartphone experience and that’s exactly why the need for pinpoint security too.

What’s next?

The future of banking is highly dependent on its ability to evolve with technology and apply best practices such as DevSecOps.

And for this, every key stakeholder within an organization should be ready for technological adoption and implementation, without which a bank will fail to maintain ground and maintain customer trust.

A futuristic bank will be successful only through the interdependence of its people, processes, and technologies to build an ecosystem of security, trust, and reliance.

DevSecOps Poised for Growth

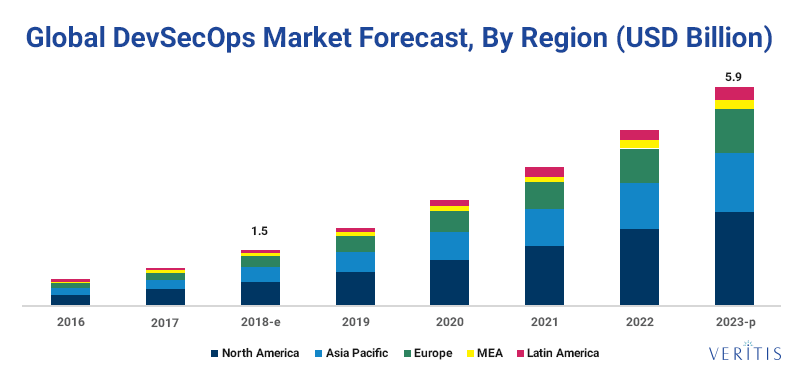

With the growing demand for DevSecOps, its market size is projected to grow from USD 1.5 billion in 2018 to USD 5.9 billion in 2023 at a Compound Annual Growth Rate (CAGR) of 31.2 percent during the forecast period.

This trend is driven by the increased demand for secure apps with a primary focus on security and compliance.

Related: