Anti-money laundering (AML) practices are critical in combating Illegal financial activities like funding terrorism and laundering money in the financial industry. Traditionally, AML compliance has relied on manual processes like customer due diligence (CDD), transaction monitoring, and reporting of suspicious activities. However, these methods are resource-intensive and prone to human error.

Traditional AML processes, while effective to a certain extent, face significant challenges. These include manual data handling, time-consuming tasks, high costs, and inefficiency in detecting sophisticated money laundering tactics. A change is needed. Financial institutions are now adopting technology-driven approaches to address these challenges, integrating data analytics, artificial intelligence (AI), and machine learning (ML) into their AML frameworks.

This shift towards technology-driven AML compliance is a necessity and a beacon of hope. It enables automation, enhances data analysis, and improves complex money laundering pattern detection. AI and ML solutions play a crucial role in analyzing large volumes of data accurately and swiftly, reducing reliance on human resources and paving the way for a more efficient and effective AML field.

Financial crime remains a substantial threat to the global economy, with an estimated annual cost ranging from USD 1.4 trillion to USD 3.5 trillion. Combatting these crimes is costly, with large banks spending around USD1 billion annually on anti-money laundering (AML) efforts.

AML experts suggest that analysts devote up to 80% of their time sourcing data rather than addressing issues directly, indicating ample room for improved solutions to streamline data collection. Advancements are underway in leveraging advanced analytics, artificial intelligence (AI), and machine learning (ML) technologies. Emphasis is also placed on employing technology for identity verification, behavioral pattern analysis, and accelerating KYC onboarding processes.

The evolution of AML compliance underscores the financial sector’s commitment to combating financial crimes and highlights the critical role of technology in crafting effective AML frameworks. However, continuous adaptation and staying abreast of technological advancements are crucial to ensuring robust AML protocols and compliance with evolving regulations.

How Does Technology Ease AML and KYC Processes?

Anti-money laundering (AML) regulations and laws are designed to thwart financial crimes and manipulative activities. Each country has distinct and well-defined AML rules.

What is AML in finance? AML in finance refers to implementing Anti-Money Laundering practices and regulations within the financial sector to deter unlawful activities such as money laundering and the financing of terrorism.

What is AML in banking? AML banking standards anti-money laundering measures implemented by financial institutions to identify and thwart money laundering activities, ensure compliance with regulatory standards and protect the integrity of the banking system.

KYC, a component of AML, encompasses practices to identify customers or businesses before their initial transaction. It includes verifying customer details like name, address, age, legal identity, and nationality. Moreover, agents and brokers must detect potential illegal financing schemes, especially in real estate transactions.

Businesses vulnerable to money laundering must have robust AML compliance strategies to avoid penalties from regulators. However, implementing these strategies initially can be daunting due to extensive paperwork and the need for comprehensive staff training.

Technology plays a crucial role in easing AML compliance burdens. Advancements like AI, ML, and big data analytics can significantly mitigate the risk of money laundering. These technologies help automate processes, improve accuracy, and stay updated with evolving AML regulations.

Useful Link: How Veritis Anticipates and Resolves Financial Service Challenges

How Can Big Data, AI, and ML Help You Counter Money-laundering Risks?

Big Data, AI, and ML have revolutionized the fight against financial crime, offering cost-effective and rapid solutions. Companies now embrace advanced technology for a more efficient and innovative approach to tackling illicit activities.

Financial institutions (FIs) and Designated Non-Financial Businesses and Professions (DNFBPs) are shifting from rigid rule-based methods to dynamic, technology-driven programs. These modern approaches are holistic, flexible, and adept at efficiently detecting abnormalities.

Automation and Artificial Intelligence have significantly accelerated traditionally slow manual processes, reducing the risk of human errors and manipulations. By leveraging efficient software, organizations save valuable time and resources while improving accuracy.

AI capabilities extend to rapidly identifying transaction patterns, anomalies, and behavioral insights. This empowers AML compliance professionals to focus on analyzing results, collaborating with peers, and investigating root causes, enhancing overall effectiveness.

Moreover, technology has expanded beyond transaction monitoring. Big Data enables businesses to move from mere transaction tracking to identifying patterns across vast datasets. This facilitates more accessible and more effective tracing of illegal activities and transaction sources.

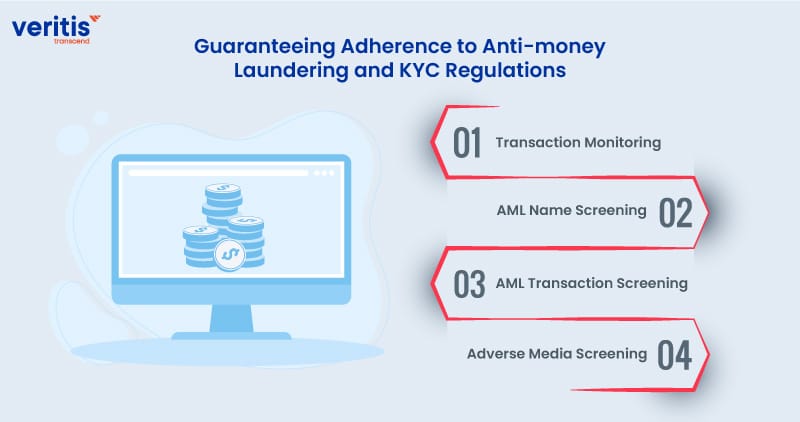

Guaranteeing Adherence to Anti-money Laundering and KYC Regulations

Anti-money laundering (AML) solutions supported by artificial intelligence (AI) are crucial in ensuring compliance with regulations while minimizing financial risks. Here are vital solutions that facilitate AML and Know Your Customer (KYC) processes in finance:

1) Transaction Monitoring

A critical aspect of AML in finance is that transaction monitoring software helps businesses assess daily transactional risks. This software allows financial institutions to set up automated rules to detect suspicious and high-risk activities, ensuring adherence to AML obligations without extensive coding knowledge.

2) AML Name Screening

AML name screening software assists in meeting sanctions, Politically Exposed Persons (PEP) scanning requirements, and adopting a risk-based approach. It helps comply with local and global AML policies, reducing regulatory penalties and enabling Customer Due Diligence (CDD) and KYC transactions.

3) AML Transaction Screening

This software enables banks and Designated Non-Financial Businesses and Professions (DNFBPs) to verify sender and receiver details swiftly, minimizing financial crime risks. Customizable search options and advanced parameters enhance accuracy in AML transactional screening, supporting comprehensive results.

4) Adverse Media Screening

An essential step in AML compliance, adverse media screening software tracks negative news related to potential clients. This includes identifying risks associated with terrorist financing, arms trafficking, corruption, and more. Advanced media screening during customer onboarding aids in comprehensive risk assessment and compliance with AML processes.

Incorporating these AML solutions empowers financial institutions to navigate the stages of anti money laundering finance effectively. Utilizing AI-driven technology and tools enhances AML finance, AML structuring, AML services, and overall compliance efforts in the banking and finance sectors.

Useful Link: Securing the Future: AI Automation Tools in Cybersecurity

Technology’s Impact on AML Compliance

1) Automation and AI-driven Solutions

One of the most significant advancements in AML and compliance is adopting automation and AI-driven solutions. Automated processes for customer due diligence, transaction monitoring, and risk assessment have significantly reduced manual workloads while improving accuracy and effectiveness. AI algorithms can predict enormous amounts of data in real time, identifying suspicious patterns and anomalies that human analysts might overlook.

2) Big Data Analytics

The utilization of big data analytics has revolutionized how financial institutions analyze and interpret customer data. By aggregating and analyzing diverse data sources, including transaction histories, social media activity, and external databases, institutions can comprehensively view customer behavior and detect potential money laundering activities.

3) Machine Learning for Predictive Analysis

ML algorithms are increasingly utilized for predictive analysis in AML and compliance. These algorithms can gather insights from historical data patterns to identify emerging trends and potential risks. This proactive approach helps institutions stay ahead of evolving financial crimes and adjust their compliance strategies accordingly.

4) Blockchain Technology

Blockchain technology is gaining traction in AML and compliance due to its immutable and transparent nature. By leveraging blockchain for transaction recording and verification, financial institutions can enhance the traceability of funds and reduce the risk of fraudulent activities.

5) Data Visualization and Reporting

Technology has revolutionized AML and compliance by enabling data visualization and reporting tools. These AML tools transform complex data into interactive visuals and detailed reports, aiding in identifying trends and anomalies to detect money laundering activities effectively. Advanced reporting features ensure real-time transparency and support informed decision-making, empowering financial institutions to proactively strengthen AML finance strategies, enhance risk management, and combat financial crimes.

Useful Link: AIOps Use Cases: How Artificial Intelligence is Reshaping IT Management

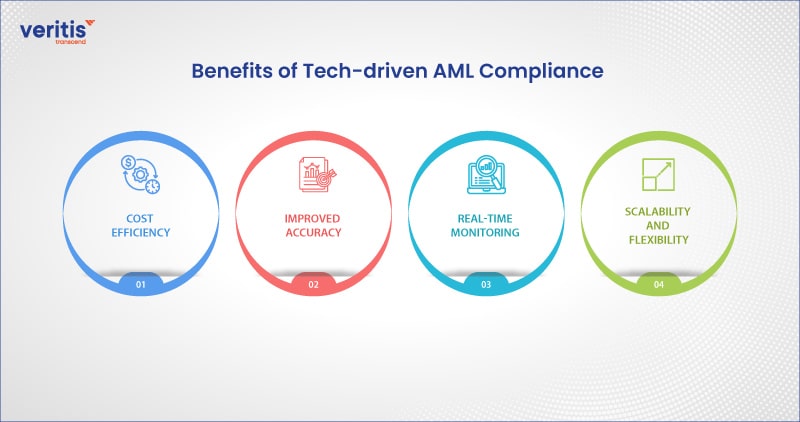

Benefits of Tech-driven AML Compliance

Tech-driven AML compliance offers a range of benefits that are crucial for modern financial institutions:

1) Cost Efficiency

AML Technology-driven AML solutions significantly reduce operational costs by automating manual processes and investigations. This includes savings in manpower, resources, and time otherwise dedicated to labor-intensive tasks.

2) Improved Accuracy

AI and machine learning algorithms can process massive amounts of data accurately. This enhances the ability to detect suspicious activities, patterns, and anomalies while reducing the occurrence of false positives that can consume valuable resources.

3) Real-time Monitoring

Automated systems monitor transactions in real-time, prompting the identification of potential risks as they occur. This proactive approach enables quick responses and mitigates the impact of fraudulent activities or money laundering attempts.

4) Scalability and Flexibility

AML Technology solutions are designed to scale seamlessly as the volume of data grows. They can handle large datasets efficiently and adapt to changing regulatory requirements and emerging threats. This scalability ensures that AML compliance remains effective and robust even in dynamic and evolving environments.

Overall, these benefits highlight the transformative impact of technology on AML compliance, enabling financial institutions to operate more efficiently, accurately, and responsively in combating financial crimes and ensuring regulatory compliance.

Conclusion

Technology has proven to be a game-changer in enhancing AML compliance within the finance sector. Integrating automation, artificial intelligence (AI), big data analytics, and blockchain technology has improved the effectiveness of AML programs and empowered financial institutions to mitigate risks and protect the financial system’s integrity. Embracing these technological advancements is imperative for staying ahead in the constant battle against financial crimes.

It’s worth noting that organizations like Veritis, winners of prestigious awards such as the Stevie Awards and Globee Business Award, offer innovative tech solutions that can revolutionize AML compliance strategies. These recognitions underscore the importance of leveraging cutting-edge technologies to strengthen AML frameworks and ensure regulatory compliance in today’s financial era.

Looking for Support? Schedule A Call

Also Read:

- How Financial Risk Management Software Mitigates Fraud in the Financial Industry

- The Rise of Artificial Intelligence and Machine Learning in Financial Decision Making Processes

- The Future of IT Financial Management: Trends and Innovations

- How Veritis Anticipates and Resolves Financial Service Challenges

- 5 Key Benefits of Implementing Cloud Financial Services for Your Business

- Impact of Information Technology on the Financial Industry