Cloud computing is one of the hottest buzzwords in the IT field. The largest public cloud providers offer easy-to-set-up, highly scalable, and generally affordable benefits. With various of the largest cloud providers currently available, Amazon AWS, Microsoft Azure, and Google GCP stand out proudly as the top contenders. They have already reported double-digit growth in cloud computing prices. However, one must acknowledge that these cutting-edge cloud solutions come at a specific cost. This blog will delve into AWS Vs Azure Vs GCP cloud cost comparison and see how they fare. But before we do, let’s understand the current state of the cloud market.

In 2023, the cloud computing landscape continues to be dominated by key players, with Amazon Web Services (AWS) maintaining a significant market share of 32%, according to AAG IT Support. Following closely, Microsoft Azure holds a notable 23%, as reported by Acropolium, while Google Cloud Platform (GCP) secures a 10% share, as per the same source.

These statistics underscore AWS’s continued leadership in the cloud market, with Azure and GCP also playing substantial roles, showcasing the dynamic competition among these significant cloud service providers.

When it comes to pricing, the competition remains intense. Key instances, such as AWS t4g.large, Azure B4ms, and GCP e2-standard-4 boast varying discounts, providing users with cost-efficient options based on their specific needs. Moreover, the inclusion of Oracle VM.Standard3.As reported by CAST AI, Flex, with a 1% discount, adds diversity to the pricing field.

Beyond market share and pricing, enterprise usage statistics reveal Azure leading with an 80% adoption rate, slightly ahead of AWS, which holds 77% of enterprise usage, according to CAST AI. Additionally, each cloud provider distinguishes itself through its service offerings, with price comparison AWS Azure Google presenting the broadest range of services, Azure showcasing strong integration with Microsoft products, and GCP focusing on open-source technologies and machine learning, as highlighted by Channel Insider.

According to CNBC, AWS sustains a growth rate of 12%, maintaining its stronghold in the industry. In contrast, Microsoft Azure outpaces both AWS and GCP with an impressive growth rate of 29%, as reported by CNBC, showcasing its accelerated momentum in the market. However, GCP, while still growing at a commendable 22%, experiences a slowdown compare GCP AWS Azure pricing to the previous quarter, highlighting the dynamic nature of the cloud industry’s competitive field.

Financially, the revenue figures underscore these cloud giants’ substantial impact on the market. AWS leads with a revenue of USD 79.4 billion in 2023, according to Synergy Research Group, while Azure follows closely with USD 74.7 billion, as reported by CNBC. GCP maintains a notable revenue of USD 28.4 billion, further illustrating the robust financial performance of these major players in the cloud computing domain.

Other noteworthy statistics include Azure’s significant presence among Fortune 500 companies, with 95% utilizing its services and 40% of Azure users located in the US, according to Acropolium. Additionally, as noted by HG Insights, GCP stands out, with 84% of its customers exclusively using its platform. Despite Azure’s notable growth, AWS vs Google cloud pricing continues to lead in overall market share, highlighting the enduring competitiveness of these cloud service providers.

Furthermore, according to CNBC, Microsoft’s emphasis on AI has propelled Azure’s growth, surpassing AWS and Google in the latest quarter. Notably, Google Cloud Platform’s robust growth in AI and machine learning further positions it as a key player in the evolving cloud storage cost comparison field.

Picking an integrated cloud vendor for your organization is not an easy task. One has to consider multiple factors, some of which are unique needs, business goals, workloads, and requirements. One of the criteria is pricing. While cloud technology is about making things cost-effective, it is tough to choose from AWS, Azure, and Google as pricing can vary widely by different plans, service choices, features, discount options, resource use, and more.

Amazon Web Services (AWS), Google (GCP), and Microsoft (Azure) are the most prominent public cloud providers market share, and they have a multi-billion dollar market share in the cloud pricing computing arena. While all three provide similar vital functions, which public cloud provider best suits your organization in terms of pricing? Our Veritis team will help you pick the right vendor for your platform.

Before going into an in-depth AWS Vs. Azure Vs. For the GCP cloud cost comparison, we will cover the estimated amount you can expect to pay as an average user for each provider. First, let’s have detailed info about each provider and the comparison of AWS vs Azure vs GCP.

Useful Link: Cloud Implementation Services: Strategy, Solutions and Benefits

Amazon Web Services (AWS)

AWS came into the limelight in 2006 with services like Simple Storage Service (Amazon S3) and Elastic Compute Cloud (EC2). In 2009, it offered more services such as Elastic Block Store (EBS), Content Delivery Network (CDN), and Amazon CloudFront. Amazon offers more than 18,000 services ranging from productivity tools to machine learning.

Amazon Web Services is the most standard cloud storage cost comparison service for object archiving, and it holds the biggest chunk of the current cloud provider security. It comprises decadent tools like IoT, security, databases, management, analytics, and enterprise applications. On the other hand, AWS cloud server pricing Service S3 offers reliability, scalability, accessibility of information, and efficiency.

AWS market share dominates the global market with a revenue share of 32%, while Azure has a 23% market share, and GCP has an 11% market share.

Microsoft and Google compete with AWS by reducing their prices. AWS is one of the best cloud services providers as their server pricing provides a pay-as-you-go model for its services as users pay what they consume for their service, and once they finish the services, there is no need to pay the additional amount or termination fees.

Inside AWS vs Azure pricing, the pricing format is complicated enough to make you seek a third-party app to manage all these services. However, for the minimum instance (for 2 virtual CPUs and 8 GB RAM), Amazon will cost you nearly USD 69/month, while the maximum instance (for 128 virtual CPUs and 3.84 TB RAM) will increase you to nearly USD 3.97/hour.

Measurement specifications for Amazon S3

Storage volume: 200 GB per month

Data scan: 200 GB per month

Data return: 200 GB per month

PUT, COPY, POST, LIST requests: 10,000

GET, SELECT, and all other requests: 10,000

With the data above, we estimated the minimum total you would need to spend per month for your MVP (minimum viable product). The prices of Amazon S3 vary from one region to another. In perspective, the cost in some regions would be: UK – USD 5.47, US East – USD 5.20, US West – USD 5.87. Meanwhile, all other places would average at USD 5.5. The cloud storage prices are USD 4.65 per month for all outlined locations.

Useful Link: Accelerate Business Growth with AWS Cloud Migration

Microsoft Azure

Azure provides numerous cloud pricing comparison types that cater to multiple companies’ requirements. Data Lake Storage and Queue Storage are some of the best Azure options for big companies that need high data storage requirements. Bulk storage is ideal for companies opting for a large amount of unstructured data, while File storage is reliable and designed for most business requirements.

Azure vs AWS pricing depends on multiple factors, such as the management level, the capacity required, and the location. Additionally, it offers a free tier, which allows free forever for some specific models and the unrestricted use of certain models for the first 12 months only.

Like AWS, Azure pricing offers the pay-as-you-go pricing model. It also provides an alternate option to pre-purchase its service, which it calls a “Reserved Instance” (upfront commitment). This scenario requires a one or 3-year commitment for many of their products. With Reserved Instance, you can receive up to a 72 percent discount for Azure services. It also offers spot instances, allowing users to purchase VMs from Azure’s spare capacity at a low price.

The pay-as-you-go approach is charged per second, and users can start or stop the service as per requirement and pay for what they use. On the other hand, the Reserved Instance is built for continuous use, and it is based on the entire month’s cost (730 hours). The pay-as-you-go model also depends on a 730-hour analysis per the pricing calculator.

Therefore, when comparing both the models, 730 hours Reserved Instance vs 730 hours pay as you go, the Reserved Instance model looks best by estimating with the price calculator that you need to use Azure cloud services pricing for a year or more.

Microsoft Azure allows a wide range of services, such as computing, networking, storage, and analytics. Therefore, its pricing model depends on various factors, including the capacity required, the location, the type of service, and the management level.

Azure Pricing Model

| Service | Starting Cost | Workload | Cost Factor | Monthly Cost |

| Block Blob storage (ZRS COOL) | USD 0.013 | Reserving 100 GB for 1 month | GB – Month | 0.013*100 = USD 1.3 |

| Block Blob storage (ZRS HOT) | USD 0.023 | Reserving 100 GB for 1 month | GB – Month | 0.023*100 = USD 2.3 |

| Functions | USD 0.20 | Serverless functions for 30 days with 5 million executions per day | Million executions | 30*5*0.2 = USD 30 |

| Linux virtual machines (VMs) | USD 0.004 | 10 virtual machines are using for 30 days | Virtual machine hourly usage | 10*30*24*USD 0.004 = USD 28.8 |

| Total | Price for 200 GB storage, serverless functions for 30 days with 5 million executions per day, and 10 virtual machines | Price USD 62.4 | ||

Useful Link: How of Cloud Migration: Azure and Its 4-Step Strategy

Google Cloud Platform (GCP)

Within a short period, Google Cloud has emerged as a strong competitor for the other two big platforms in cloud services. It stands out among them with its endless IT expertise and internal research. Google features many hosted services for computing, storage, and application development, such as Platform as a Service (PaaS) and Infrastructure as a Service (IaaS).

GCP pricing provides multiple pricing models, including free tier options, long-term reservations, and pay-as-you-go pricing. Moreover, Google Cloud prices are affected by several factors like compute, SQL, network, storage, and serverless pricing. These components should be explored when selecting a cost structure for your enterprise.

Google Cloud price offers its customers USD 300 credit for free as customers can spend their amount on their Google Cloud products. Additionally, users can use multiple free products like computing, storage, database, IoT, and Artificial Intelligence, the most widely used, most extensive cloud pricing comparison providers’ market share.

Furthermore, the US tech giant provides substantial discounts for products committed to a certain usage level for one or three years in advance, also known as “committed use.”

Google Cloud price allows a unique option for its users, ‘Sustained Use discounts’. This offer is automatically applied on a sliding scale by the percentage usage of the services throughout the month. You can even combine non-overlapping instances with claiming the benefits of a percentage discount up to the maximum level without any prepayments or commitments.

Useful Link: Full Advantage of Cloud Migration with GCP

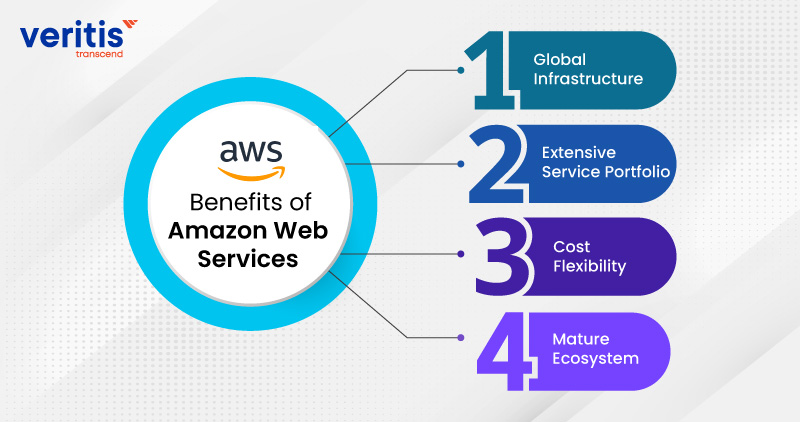

Benefits of Amazon Web Services (AWS)

1) Global Infrastructure

AWS boasts a vast and robust global infrastructure with data centers strategically located worldwide. This ensures low-latency access to services, making it an ideal pick for companies with a global presence.

2) Extensive Service Portfolio

AWS offers extensive services, from computing power to storage, machine learning, and analytics. This versatility allows businesses to tailor their cloud environment to suit their needs.

3) Cost Flexibility

AWS vs Azure cost provides various pricing models, but AWS offers on-demand, reserved, and spot instances. This flexibility enables organizations to optimize costs based on usage patterns and requirements.

4) Mature Ecosystem

With a large and active user community, AWS has a mature ecosystem supported by various third-party tools and integrations. This makes it easier for businesses to find solutions and support for their needs.

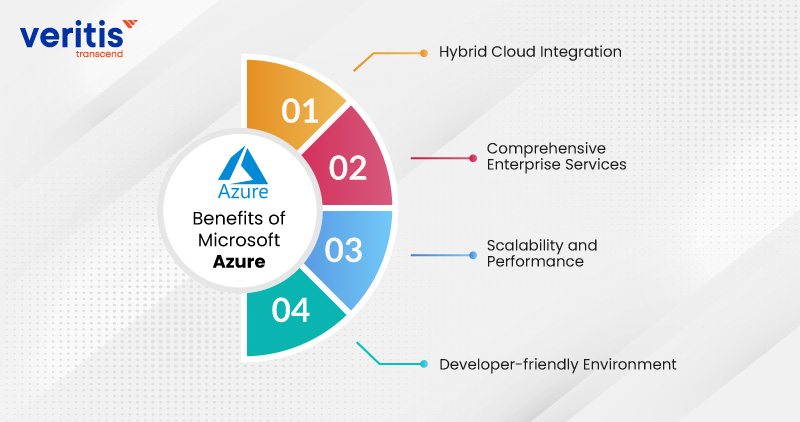

Benefits of Microsoft Azure

1) Hybrid Cloud Integration

Azure stands out for its seamless integration with on-premises infrastructure, offering a robust hybrid cloud solution. This is beneficial for businesses with existing investments in Microsoft technologies.

2) Comprehensive Enterprise Services

Azure is well-suited for enterprises, offering comprehensive services, including Azure Active Directory, Windows Virtual Desktop, and various enterprise-grade applications. This makes it an attractive option for organizations looking for an end-to-end solution.

3) Scalability and Performance

Azure provides scalability and high-performance computing capabilities, making it suitable for resource-intensive workloads. The ability to scale resources up or down and rely on demand contributes to efficient Azure vs AWS cost management.

4) Developer-friendly Environment

With a focus on integrating popular development tools and frameworks, Azure provides a friendly environment for developers. This can be advantageous for organizations with a strong emphasis on application development.

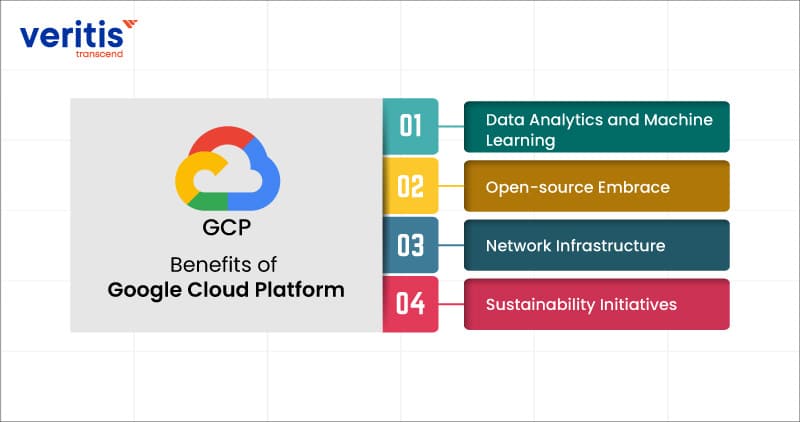

Benefits of Google Cloud Platform (GCP)

1) Data Analytics and Machine Learning

GCP excels in data analytics and machine learning services. With tools like BigQuery and TensorFlow, organizations can derive meaningful insights from their data, making GCP cost a preferred choice for data-driven businesses.

2) Open-source Embrace

GCP has a solid commitment to open-source technologies. This can be advantageous for businesses that rely on open-source solutions, as GCP vs. AWS pricing provides native support for many popular open-source projects.

3) Network Infrastructure

Google’s global network infrastructure is known for its speed and reliability. GCP compute pricing offers a high-performance network, ensuring low-latency access to services and efficient data transfer.

4) Sustainability Initiatives

Google is known for its commitment to sustainability, and GCP cost reflects this with a focus on environmentally friendly practices. This can be appealing to organizations that prioritize eco-friendly and socially responsible solutions.

AWS Vs. Azure Vs. GCP Cloud Cost Comparison

| Detail | Amazon AWS | Microsoft Azure | Google GCP |

| Minimum Instance | 2 virtual CPUs, and 8 GB of Ram will price you around – USD 69/month | 2 virtual CPUs, and 8 GB of Ram will price you around – USD 70/month | 2 virtual CPUs, and 8 GB of Ram will price you around – USD 52/month |

| Maximum Instance | 3.84 TB Ram, 128 vCPUs will price you around – USD 3.97/hour | 3.89 TB Ram, 128 v CPUs will price you around – USD 6.97/hour | 3.75 TB Ram, 160 v CPUs will price you around – USD 5.32/hour |

| Type of Discount | Reserved Instances (RIs) | Reserved Instances (RIs) | Committed Use Discount (CUD) Sustained Use Discount (SUD) |

| Commitment | 1 or 3 years | 1 or 3 years | Committed Use Discount (CUD) – 1 or 3 years Sustained Use Discount (SUD) – no commitment |

| Discount percentage | Up to 75 percent | Up to 72 percent | Committed Use Discount (CUD) – for 1 year up to 37 percent or 3 years up to 55 percent Sustained Use Discount (SUD) – up to 30 percent |

| Is cancellation available? | Yes, it offers to sell your products on the marketplace | Yes, they will charge a 12% cancellation fee | No cancellation is available |

| Payment options | 3 options are available on AWS – no up-front, partial up-front, all up-front | All up-front | No up-front |

| High Profile Customers | LinkedIn, Facebook, BBC, Airbnb, Twitch, Netflix, Adobe, ESPN, Lamborghini, etc. | Apple, HP, Coca-Cola, LG Electronics, Verizon, Xbox, Fujifilm, etc. | Twitter, Intel, Yahoo, PayPal, eBay, Target, 20th Century Fox, etc. |

Cessation for AWS, Azure and GCP Pricing Models

The three prominent cloud vendors AWS vs Azure vs Google cloud have successfully claimed the top places in cloud computing price, and they have a very cutthroat competition to secure the number one position in the cloud landscape market. The world’s top 3 cloud infrastructure vendors are decreasing their prices regularly. They also offer unique pricing models and different discount options, making it hard to pick in the current scenario. AWS Azure Google price comparison depends on the services you require for your business. AWS vs Azure vs Gcp market share follows 33 percent, 23 percent, and 11 percent in 2023.

Before picking your company’s best cloud service provider, know your requirements and end goal. For example, if millions of users are operating your application and your organization uses thousands of instances, this blog post will guide you to save thousands of dollars. AWS vs GCP vs Azure pricing depends on the services you require and can vary widely by different plans, discount options, features, resource use, and more.

You can opt for AWS cloud services if your enterprise needs a deep feature portfolio. GCP pricing is better for organizations seeking optimal innovation and low cost. Azure is the best choice for companies that are primarily operating Microsoft products.

The myriad choices may make it challenging to decide which one to go with. Instead of choosing between one of the three, why not go with a multi-cloud strategy that gets you the benefits of the various cloud provider comparisons? However, implementing a multi-cloud strategy is easier said than done, which is one of many reasons companies seek Veritis’s services.

Veritis, the Stevie and Globee Business Awards winner, offers a platform to discuss and explore emerging technologies in unprecedented breadth and depth. Veritis has a dedicated team of experts to find the best solution within the budget for your organization. We deliver many services, from cloud and DevOps services to technology advisory.

Want to know more about Veritis’ capabilities?

Explore Cloud Solutions and Services Talk to Our Cloud Migration Expert

Additional Resources:

- Top 15 AWS Machine Learning Tools in the Cloud

- 6 Ways AIOps Optimizes Cloud Security

- Amazon Aurora Vs Amazon RDS Comparison

- MongoDB Vs RDBMS: Comparing the Big 2 Database Services

- Serverless Vs Containers: Comparison Between Top Two Cloud Services

- Which Cloud has Better Private Connectivity: AWS or Azure or GCP?